by Mirna Djuric, Product Capability Director at EyeSee

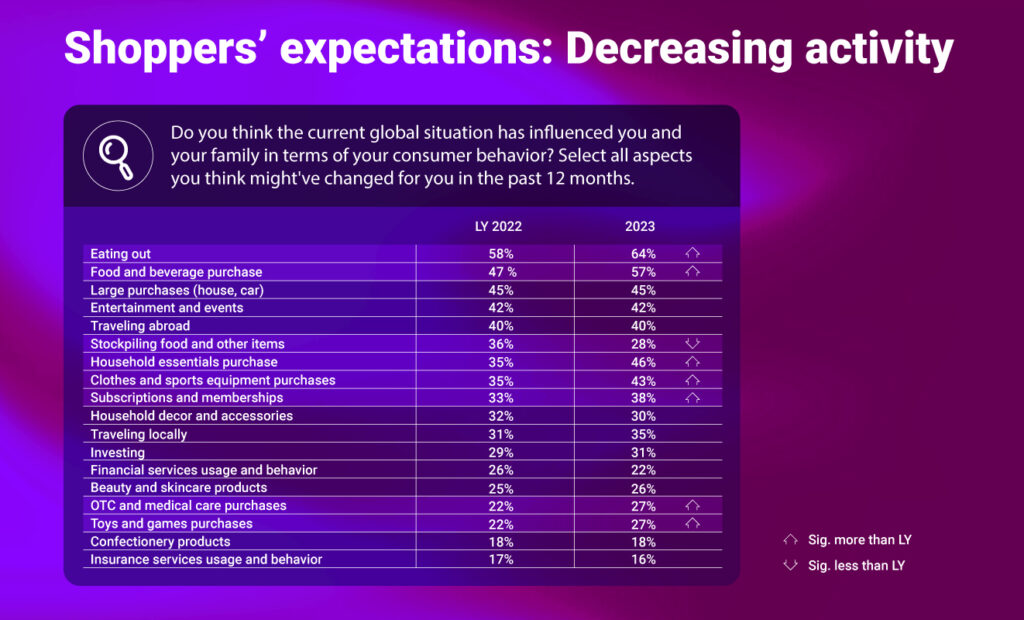

The world has gone through quite a few disruptions over the last three years. According to CPS GfK over 60% of European households are in or close to a serious budget squeeze, with Western European countries, especially on the rise. Nearly 2 in 3 consumers declare to cut their out-of-home (OOH) spending, including visiting restaurants and bars, buying clothes (-48%), as well as gifts, decorations, and takeout/delivery (all at -46%).

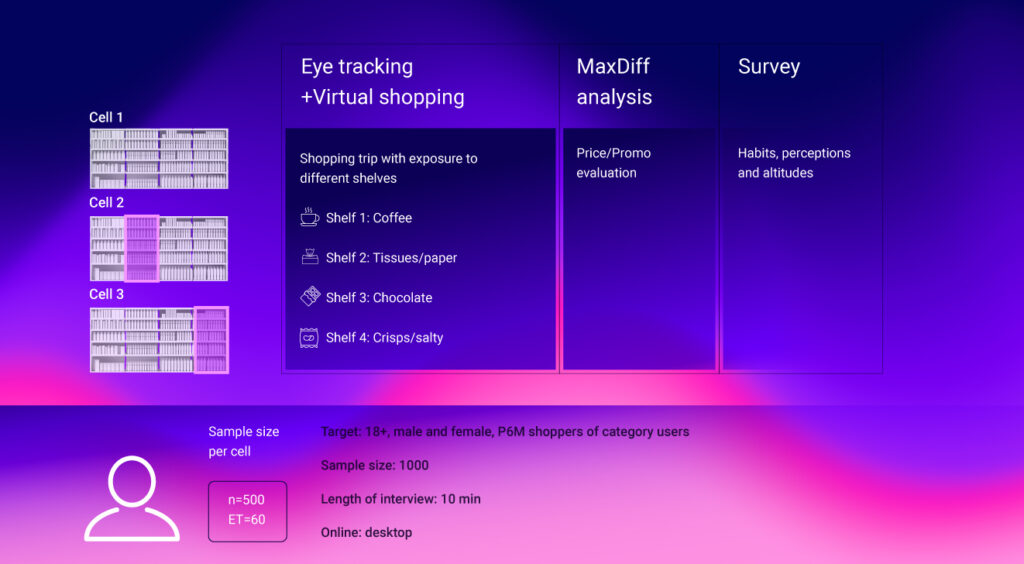

But even though shoppers are more focused on preparing meals at home, the EyeSee meta-analysis shows that the food part of FMCG has suffered the most. This meta-analysis is based on 250 studies in the FMCG category. Samples ranged from 50.000 to 150.000 respondents per method, spread over 4 geographies – US, Europe, APAC, and Latin America. They included methodologies such as Eye Tracking, Facial Coding, Virtual Shopping, and surveys, and they were all done in highly realistic shelf environments that, 95% of the time, matches actual shopping behavior.

After gathering all the data, it was grouped into pre-pandemic (2018 and 2019) and post-pandemic and all subsequent events (2020-2022), and eventually compared.

Food category products are more likable but less bought

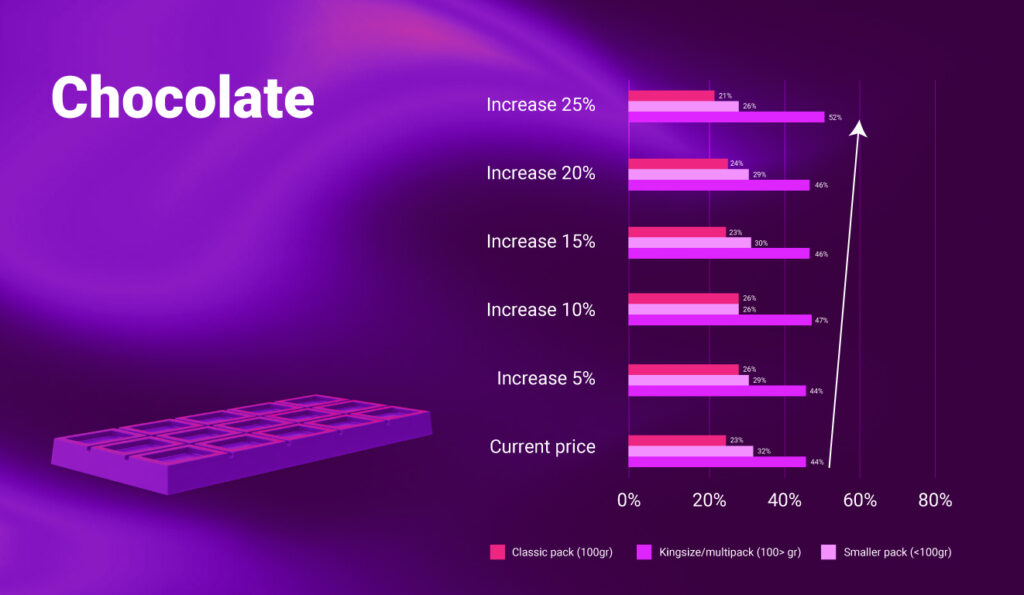

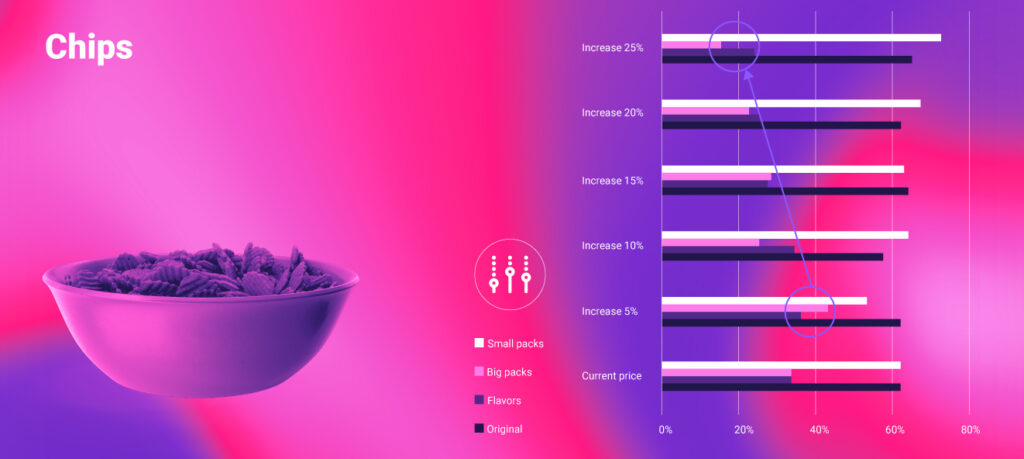

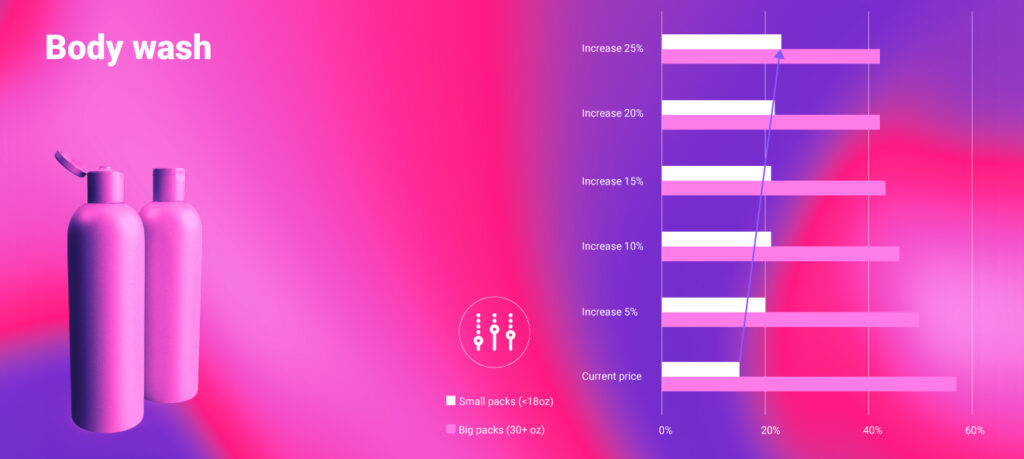

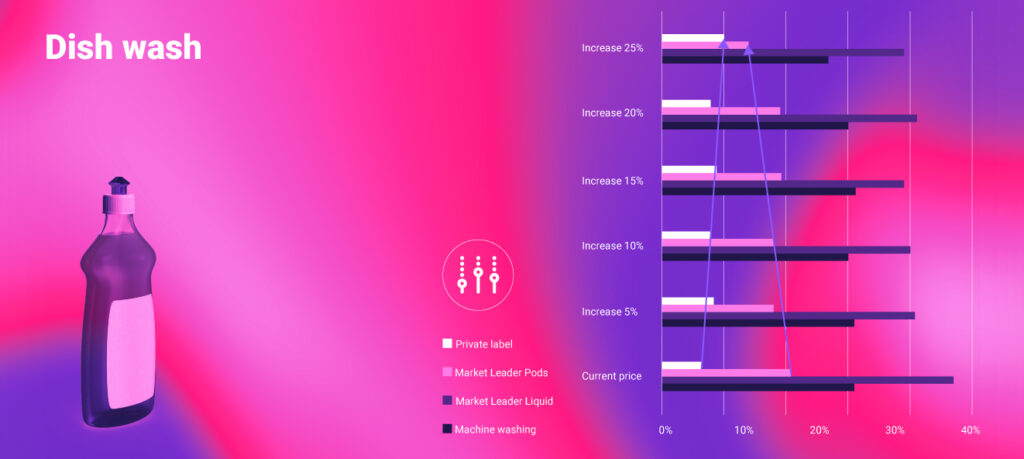

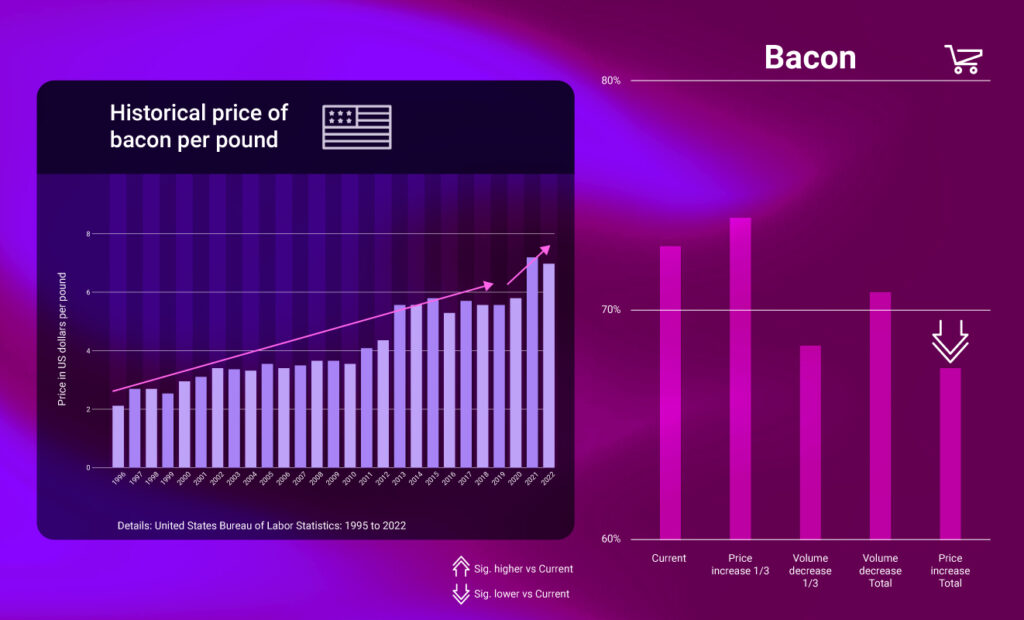

It does not appear obvious that in times when shoppers are spending more time preparing meals, food would be the most crisis-influenced category in the FMCG category. However, if we remember that one of the key takeaways from the EyeSee pricing study was that the main goal of shoppers is to spend as little as possible, even if it means buying smaller packs of products and getting less value for their money, we may be able to gain a better understanding of this type of behavior. Food products are the ones we buy every day, and we can see their price increases getting higher and higher, whereas, in other non-food categories, we do not buy as frequently, so we do not have a sense of their impact on our overall budget.

However, when shoppers are directly asked about the products, they will react positively and describe them as highly desirable, keeping in mind that we all want to resume our pre-pandemic lives as soon as possible. But what they will buy is a different story.

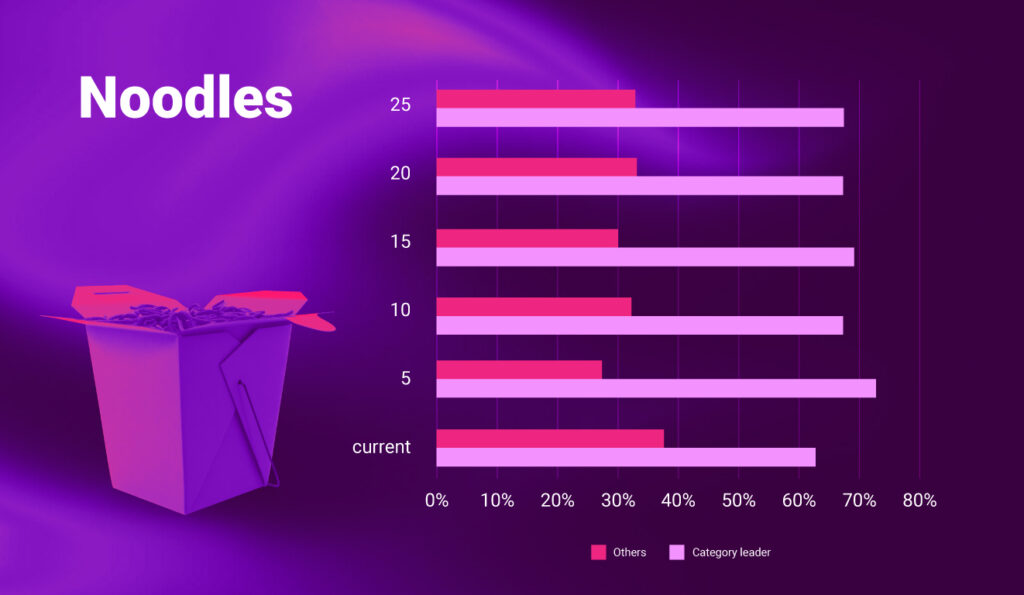

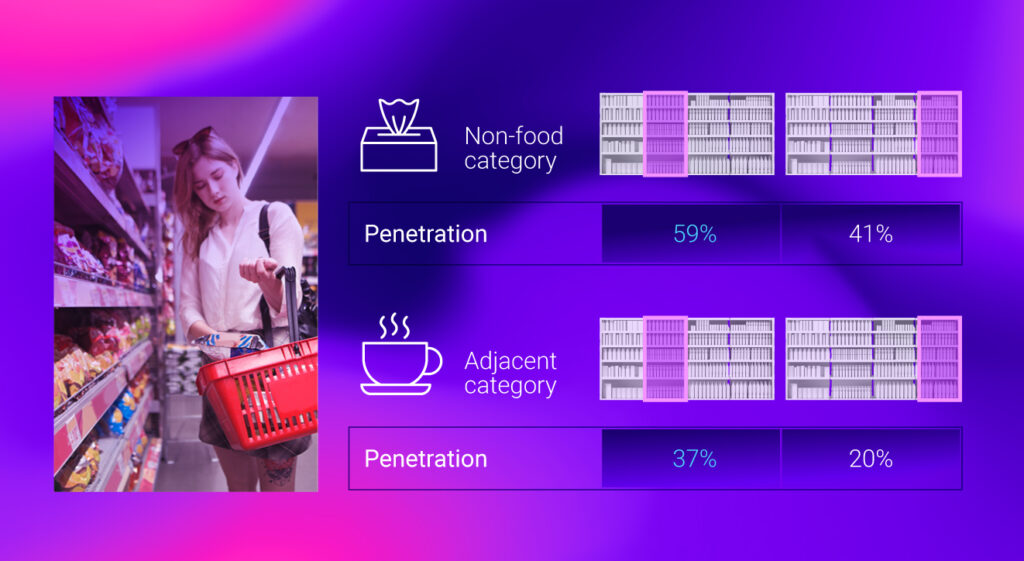

In the food segment of FMCG, both consideration and penetration rates have decreased by more than double. Simply put, fewer people are buying fewer products, and competition on the shelf is fiercer.

Shoppers’ exploratory behavior has also decreased, and individual SKUs and brands appear less visible on the shelf. Shoppers appear to spend more time finding exactly the product they intend to buy and less time exploring other options.

Visibility in the first 5 seconds dropped significantly, as did attention to the key zone, meaning shoppers’ exploratory behavior decreased and they are possibly spending time on shelves analyzing price tags instead of browsing products.

However, the likability of products significantly increased, meaning they were found to be more and more attractive and relevant.

Is e-commerce a saving grace for FMCG in the US?

With increased e-commerce spending, we can expect that FMCG in the US will potentially remain healthy. It is also interesting for this market that on the pack navigation, the US stands out by brand importance.

This is the only region where brand logos are gathering more consumer views. Like other markets, secondary images lost visibility while claims gained it. This suggests shoppers want to be more certain they are getting the product they intended to buy beforehand, meaning shopping is more targeted.

Very similar patterns are evident in the European markets as well; although actual shopping hasn’t yet universally decreased, there are indications that shoppers are more cautious (relying on tried-and-true brands) and therefore less exploratory.

The nonfood category remains stable but claims gain importance

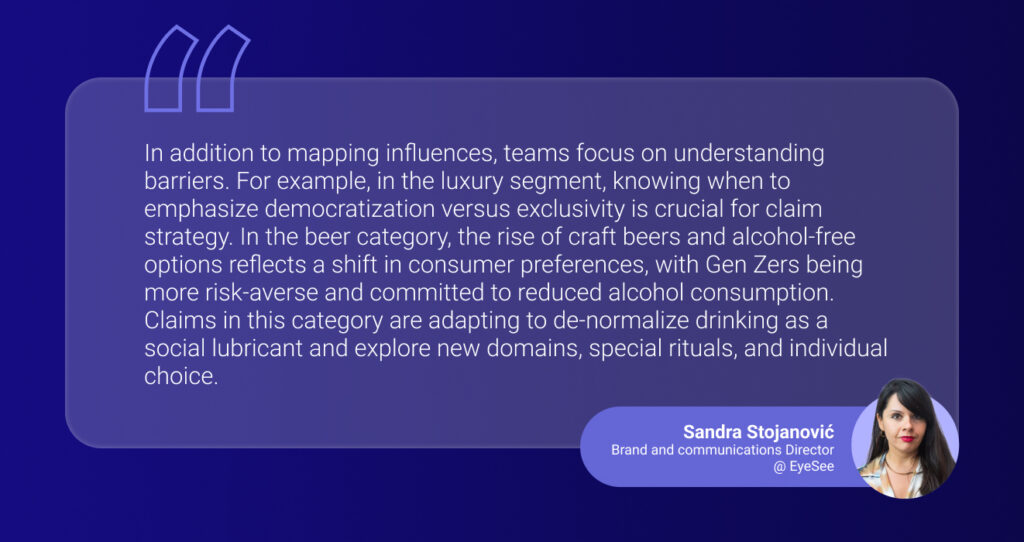

Even though non-food products are still in the same or similar demand, and even though post-pandemic cravings among shoppers are strong, when spending money in times of crisis, they may feel the need to justify their spending, so they will turn to claims and question them, having more information now than during carefree pre-pandemic times.

This higher level of caution is confirmed when looking into navigation patterns in the non-food category. Claims have gained significantly more consumer looks resulting in a 50% increase in claim visibility. Other pack elements, particularly imagery, both primary and secondary, suffered in consumer attention.

Our packaging and claim expert, Tijana Lukic, provides more context in terms of what post-pandemic consumers look for in the non-food category.

“End-user benefits are most important, and the more specific and concrete they are, the better.“ She also notices that shoppers have become true experts, they are knowledgeable about ingredients, their benefits, and their risks, so they choose cautiously.

“Shoppers are open to innovation in this category still, but they need to be educated by the pack design about what the innovation brings for them. So, the concrete benefits are appreciated. Sustainability of the product is important, but it hasn’t exited the nice-to-have category yet in most non-food categories.”

Latin American market can expect further decreases in FMCG

In the Latin American market, on the other hand, shelf purchases significantly decreased, but not only that; consumers are consciously saving. Even stated purchase intent, which usually lags the actual purchase, shows a decrease in this market. This suggests we can expect further decreases in FMCG in LATAM.

Conclusion

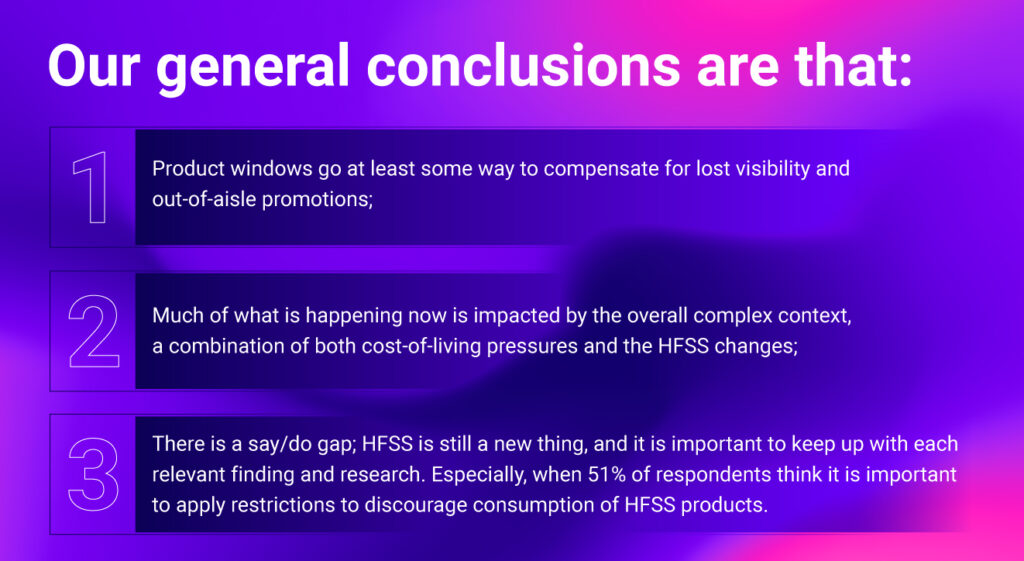

With all of these insights in mind, it is evident that different markets show different results depending on their strengths and weaknesses. However, the pressure of one crisis after another can be more or less felt everywhere. Even though the average consumer wishes to go back to his previously carefree life and spending, their budgets simply do not allow it.

From the producer’s perspective, category leaders are under more pressure than ever to sustain their market growth. If you are interested in this topic and want to learn more, register for GreenBook X EyeSee webinar on How Category Leaders Adapt to Post-Pandemic Consumer Behavior here – https://bit.ly/3Kwcs7D

Interested in findings from our pricing studies from the US and which categories have we researched? Read all about it here or you can check out the full webinar featuring Heather Graham (Director Client Service @ EyeSee), Sasa Radojevic (Sr Shopper Insight Manager @ EyeSee), and experienced retailer & Awarded 2022 Top Women in Grocery (TWiG) Raina Rusnak.