Some people hear music when they see music sheets, while others can look at the data and see valuable insights that lead to strong business development recommendations. Insight managers are a true force behind the Market Research Industry and its cornerstone, each crafting insight stories in their unique way.

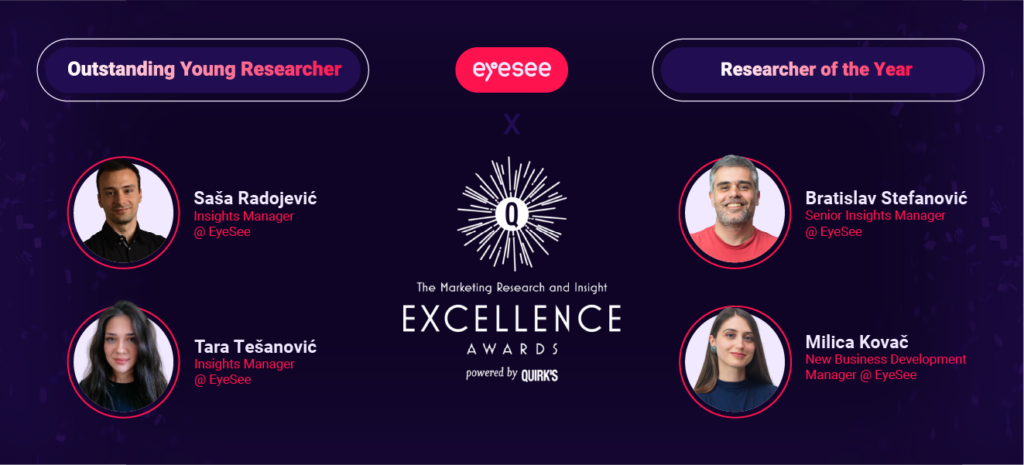

We use The Marketing Research and Insights Excellent Awards powered by Quirk’s to put them in the spotlight and give them all the credit they deserve because, without them, all we would have, is a big pile of numbers and statistics we would have no idea how to use.

We asked Tara Tesanovic, Saša Radojevic, Milica Kovac, and Bratislav Stefanovic, who are nominated for Outstanding Young Researcher and Researcher of the Year, to tell us a little bit about themselves and what inspires them in their work.

When did you realize you were hooked on behavioral insights and there was no going back?

Saša: I must admit that my mentor, Beca (Dobrinka Vicentijevic), infected me with enthusiasm and passion for turning data into insights and the magic of the aha(!) moment. I always love to experience those. You collect all the data and piece the puzzle together, trying to determine where your predictions were incorrect and, more importantly, why! So, you are constantly thinking about it, trying to connect the dots. So, when thinking about it becomes an obsession, you usually let it go, take a step back, and then it just happens.

Tara: For me, it is the gap between say and do in shoppers’ behavior that is so inspiring, and I also love how the implicit approach to research effectively reveals biases. For example, the entire marketing team may be baffled as to why some packaging labels have no impact on consumers and may have a variety of design theories, but eye-tracking methodology will quickly reveal that it is because they are positioned in such a way that they are not spotted at all.

Milica: More than 5 years ago I realized the potential of technological advancements to grant us new means to comprehend behaviors that eluded validation through simple conversations. Being a psychologist who was already deeply immersed in research by then, it felt like I stumbled upon new horizons. I’m eagerly anticipating the unfolding of future technologies in our domain.

Bratislav: It was when I started realizing that it was not always easy to decipher what respondents really thought by providing their answers and opinions to our traditionally defined questionnaires. Many times, I was left with the impression that something was missing, the unfathomable part of what they really thought or needed. Over time, I learned that consumers could easily and clearly express some of their needs, and that’s where traditional questionnaires were quite useful. But oftentimes, consumers cannot articulate their needs, and their responses can then be misleading or prone to biases. This is where the behavioral approach proved to be super useful, as all I did was to just put consumers in their typical and specific situations, with little to no influence or instruction, sit back and observe, and then look for typical patterns of behavior. This way I was much more confident with the learnings and able to draw bolder conclusions and recommendations on how to influence consumers.

The last few years have been in crisis mode for most (if not all) of us. How has the consumer changed?

Saša: I understand that the expected answer should be based on our personal impressions rather than a study with specific parameters, but I am afraid that once you recognize the importance of context and put on your insights manager glasses, you cannot just assume such things. So, I will let this one slide, if that is okay.

Tara: My personal impression is that when it comes to shopping, people become much more cautious and stricter. Especially when it comes to less frequently purchased and somewhat pricey categories like care and beauty. Shoppers will question every claim made about the product, so communication must be well thought out.

Milica: Living in a deeply consumeristic society, addressing this question isn’t straightforward. If we talk about shoppers, regardless of channel, knowing that trade is a human activity that has existed for a very long time and crisis are nothing really new to people, we see how swiftly shoppers adapt their strategies when crisis hits, making more informed and conscientious choices (crises elevate the significance of System 2 decision-making); at the same time, social media and technologically mediated social communication is a relatively young phenomenon in human history and we are witnessing those same shoppers as now social media consumers struggling to consciously dispose of their time in a way that they perceive as healthy, especially during crisis.

Bratislav: We are going through the most dynamic period with dramatic changes in the behavior of all of us as consumers. The recent events, COVID pandemic, global crisis and inflation have been shaping the way we shop and consume goods and services. During the pandemic, while locked down, we turned to e-com, but limited to spend as much as wanted, given the concerns and uncertainty, loss of jobs, but also derails in logistics, supply, or delivery. And we started craving. The moment we stepped out of it, unleashed, believing we were going back to the “old, good normal”, the global crisis and inflation hit. So, we are still torn between our wish to shop and consume, and the imposed need to prioritize and budget. But the way consumers changed their behavior depends on the category and consumers’ socio-economic level. In some categories, they started buying less or turned more to private labels. In others we observed an increase in sales of more premium brands. So, this urge to consume and spend is there, but we are reinventing and reprioritizing what is most important to us.

What is the one thing you are most proud of?

Saša: It takes a lot less time for me to reach the aha(!) moment because I believe that over time, I have improved the way I think about and approach problem-solving, and I am hopeful that this will continue.

Tara: Well, I am proud of the confidence that I have gained since I started working. When I give recommendations, I am very confident about them, and my clients act according to them. Somehow, they gave me their trust from the start; their instant confidence in me became a reason for me not to doubt myself and really feel encouraged. From that moment on, it just grew stronger.

Milica: I take pride in my diverse journey within research, spanning roles from shopper research consulting to creating and validating innovative technologies, all the way to advocating for consumer understanding through new business development.

Bratislav: For me, a business challenge has always been a creative challenge, too. So, together with clients I typically managed to design the most unusual and innovative approaches to a research problem. Very often you could consider such studies almost as pilot projects, without clear indications on how the study would end up and what the outcome would be. Fortunately, at least so far, such endeavors have ended successfully to my and the clients’ joy, which has convinced me that the “can do” attitude always pays off in the end, with a little courage, no matter how complex the challenge is, which I am especially proud of.

You look at ad and shopper behavior all the time! Ok, let’s be honest. But what kind of consumer are you?

Saša: Well, some habits never die. I used to go shopping with a list in one hand and a calculator in the other since I was a student and every penny counted, and I still do that. So, unless there is a good offer, I do not make irrational decisions impulsively. And, of course, I do the math before deciding that the discount is too good to pass up.

Tara: I am the total opposite. I want to try everything that is new. I like to try new versions of phones; I want to test every pack claim and try new flavors. When you imagine a shopper willing to engage with a product, you imagine me.

Milica: I’m sugar-free hooked! Besides that, ever since 2016, I’ve been happily immersed in the world of physical retail: whenever I hit the road, I transform into a retail explorer, tracking down mind-boggling stores across the world. To me, stores are the ultimate decision arenas. They hold the power to sway me toward novelties or classics.

Bratislav: When comparing myself to what I typically see in research studies I could say that I am quite an atypical consumer. I have my predefined set of favorite brands and usually I know what I am going to buy in advance, though I like to explore and try new things when they hit the market and quite often buy things on impulse. I rarely think about whether I am going to spend an extra buck on things I like. Typically, I assess the quality, value, and proposition a product offers rather than the costs it comes at. To illustrate my irreconcilable nature as a shopper and consumers, what may come as a surprise to many marketing people who try to “understand” consumers, if I cannot find my favorite soda (highly processed, artificially flavored) from a major brand in the store, I might as well reach for the most organic, 100% natural juice made by local small businesses.

Want to learn more about behavioral research from our experts? Find the list of EyeSee’s webinars here.