While most of the Western world is currently examining the relationship with HFSS (high fat, sugar, and salt) products, the United Kingdom is the first country to put in place concrete measures to reframe how we access and buy prepackaged goods belonging to the ‘less healthy’ categories.

Currently, the measures cover location; no HFSS food and beverage can be placed in high footfall areas of an affected store, like checkouts, end-of-aisle units, store entrances, and designated queueing areas. By the end of this year, restrictions on promotions will come into force, while advertising regulations are scheduled for early 2024. It is only a matter of time before other countries follow suit; the impact on industry will be monumental.

To help producers and retailers understand how to adjust, EyeSee’s just wrapped up a behavioral study looking into how product windows and different placements impact visibility and, ultimately, sales.

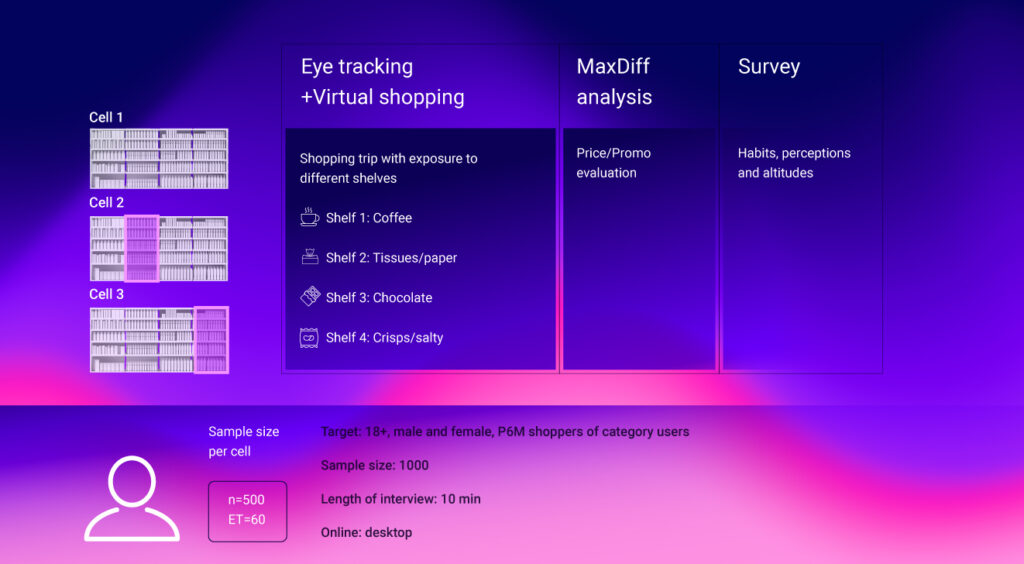

We’ve tested two locations of the product window: at the end of the aisle (Cell 3) and a central position (Cell 2); and compared those to a situation with no product windows (Cell 1), where respondents were merely shopping snacks, chocolate, coffee, and tissues each in their respective main aisles.

Here’s the breakdown of our main findings.

One thing is certain – shelf windows do attract attention

In our study, we set out to test the impact of product windows to help guide the options retailers and brands should consider when rethinking location and promotions in physical stores. The tests included two common snacking categories – chocolate and salty snacks, as well as two adjacent categories not directly related to snacking – coffee and tissues.

All respondents visited the four categories and were given a task to shop for a small gathering at home with some friends; following this, they were exposed to virtual stores and shelves.

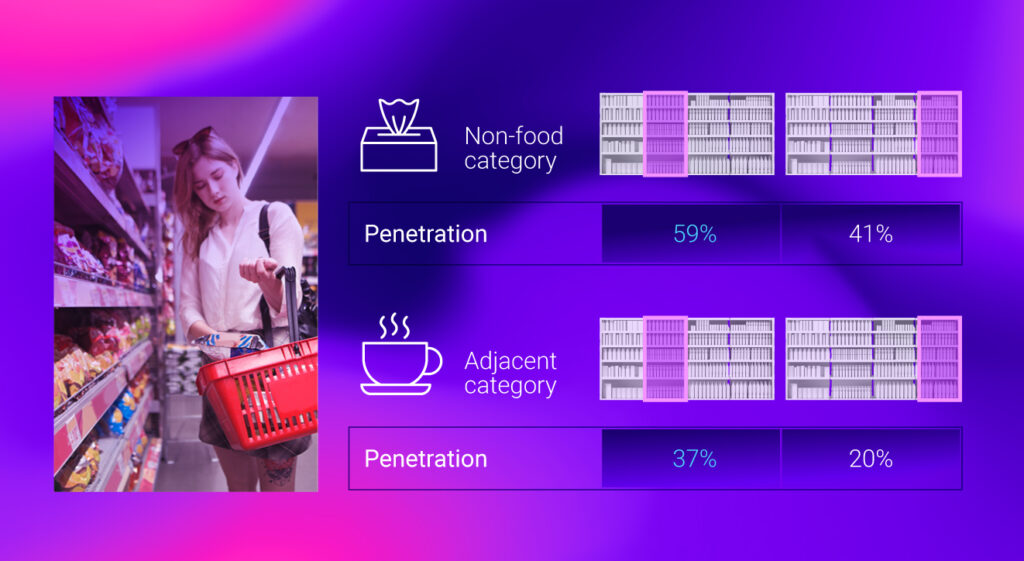

Using webcam-based eye tracking, we’ve found that in the tissues aisle, almost all respondents noticed the window regardless of the product positioning. It is prominent and stands out presumably due to the unusual placement of snacks and a surprise factor.

In the coffee shelf, almost all see the more central window, but not all look at the window at the end. While in both host categories, the window in the middle also gets longer attention.

Unexpected and non-food categories drive purchases

Visibility correlates with purchase; what is not seen is effectively not bought. Our virtual shopping tests concluded that respondents are also willing to go beyond visibility and buy from the window.

Overall, the middle window attracts more buyers and penetration, as well as purchases. Whether we look at total value or value per buyer, the middle window is more effective.

Interestingly, the window in the non-food category has a larger share of shoppers. Potentially more shoppers buy where the placement is less expected.

Positive effects on total category sales

As it is now, retailers have most of the windows within their own aisle (Pringles in crisps, Belvita or Oreo in biscuits); the ‘TESCO Clubcard’ have a mix of snacking products in snacking aisles e.g. biscuit aisle or in the chocolate aisle; Waitrose offers are a mix of products outside aisles with snacks inside the window.

However, our data shows that combining the sales from the main aisle of chocolate with the sales from the window helps the category. The window outside the snack or biscuit category goes some way to compensate for the main aisle in terms of visibility and sales. Even without promotions or special prices; simply by being there.

More challenging news is that the host categories, in this case coffee and paper products, experience a decline in sales when attention is redirected to the window and having less facings.

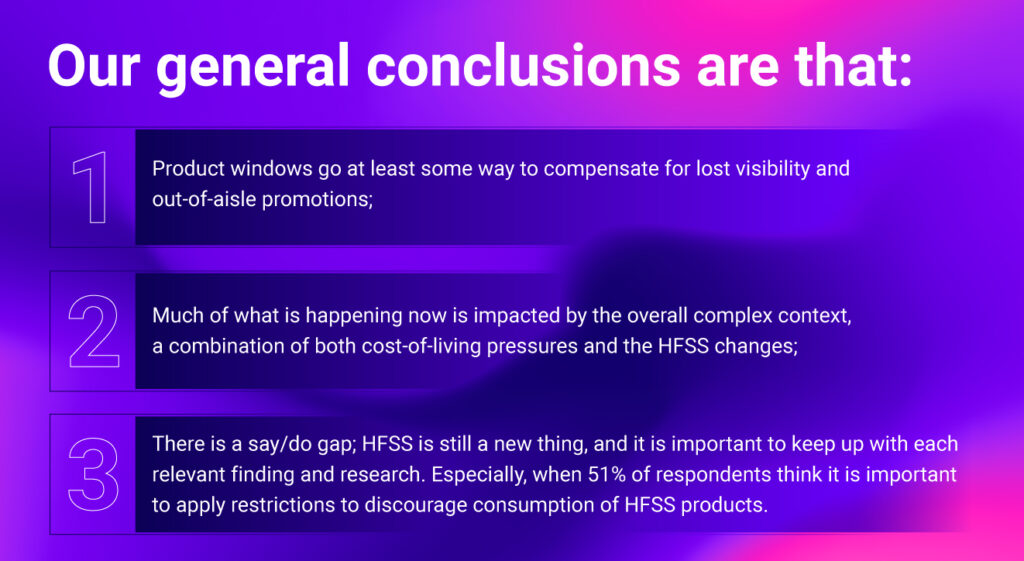

Conclusion

The shopping environment plays an important part in the way products are marketed to us, with simple factors such as the location within stores significantly affecting what we buy. Removing out of aisle promotion locations puts pressure on reframing how shoppers shop and get engaged.

Request the full study breakdown at [email protected]! If you are interested in more shopper case studies, check out our latest one on best pricing adjustment tactics for inflation.