By Cliff Kane, Senior Director, New Business Development @ EyeSee

At the recent Quirk’s Chicago conference, I had the pleasure of sharing the stage with Shilpa Khanna, Associate Director of Transformational Growth at The Clorox Company. Shilpa’s extensive experience and unwavering dedication to innovation within the CPG industry positioned her as the ideal expert to discuss the do’s and don’ts of launching new products. Our primary aim was to demonstrate effective strategies for building confidence in new packaging decisions and launches. Our discussion covered:

- The symbiotic relationship between quantitative and qualitative insights.

- The pivotal advantages of early packaging tests compared to delayed evaluations.

- The indispensable significance of testing within the context of simulated in-store scenarios, rather than solely in isolation.

In this blog post, I’ll take a closer look at key insights. For a comprehensive understanding, I highly encourage you to watch the full session recording.

The symbiotic relationship between quantitative and qualitative insights

Let’s face it – innovation is tricky.

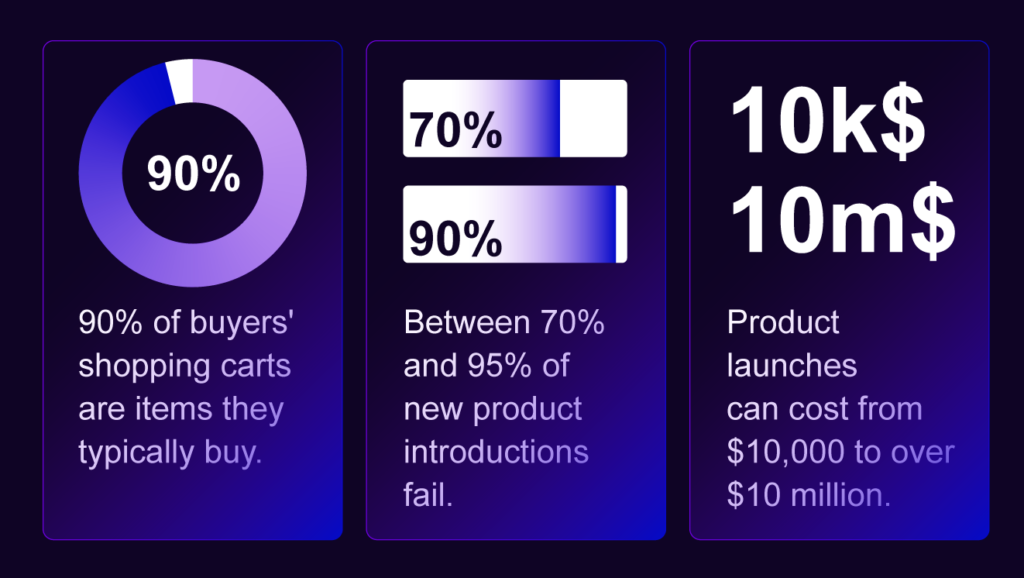

Within the highly dynamic and complex process of product development, packaging design serves as a linchpin for consumer engagement and purchasing decisions. Getting the packaging just right can be costly, as visually communicating a new-to-market proposition carries certain risks and requires alignment with ever-evolving consumer preferences.

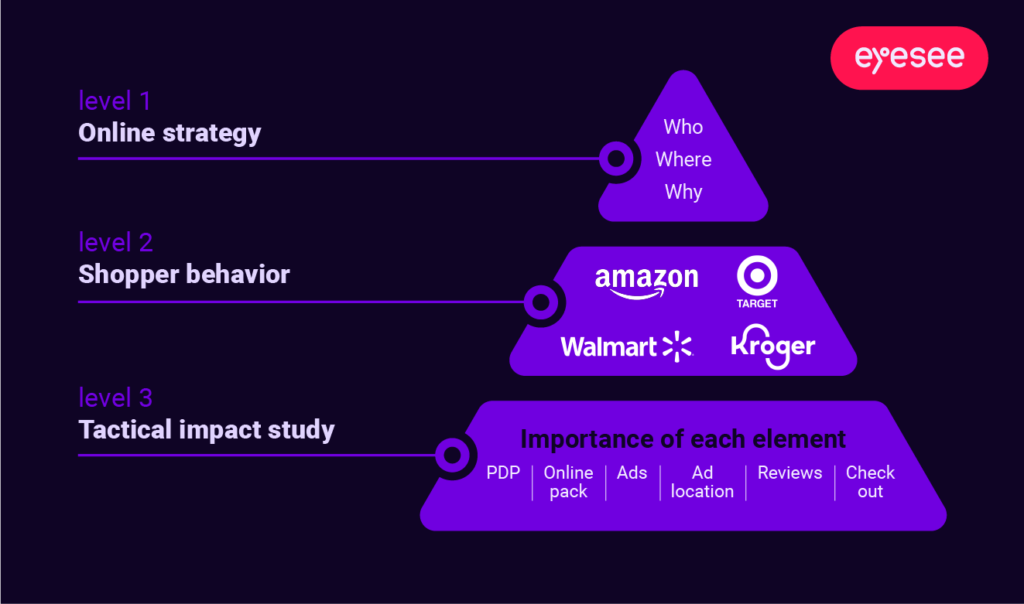

Traditional pack development often advises starting with qualitative studies to evaluate a range of design options, followed by quantitative research to validate a few “finalist” ones. However, the initial screening phase is critical. It’s like choosing the right path in a forest; if you go wrong at the start, subsequent adjustments matter little. So, objective assessments of what drives success are vital from the beginning. Starting with quantitative research to identify winning concepts enables refinement and validation, laying a strong foundation for success.

Advantages of early packaging tests compared to delayed evaluations

In the overall product development process, packaging is often perceived as the final embellishment to an exceptional product. In reality, it serves as the enticing red door that captures consumer attention, drawing them in to explore and engage with the product experience. Therefore, packaging development and assessment should occur in tandem with the core product, ideally at the earliest stages of development. During our conversation, Shilpa strongly emphasized the necessity of proactive pack design testing, serving as a guiding light to inform strategic decisions and mitigate risks:

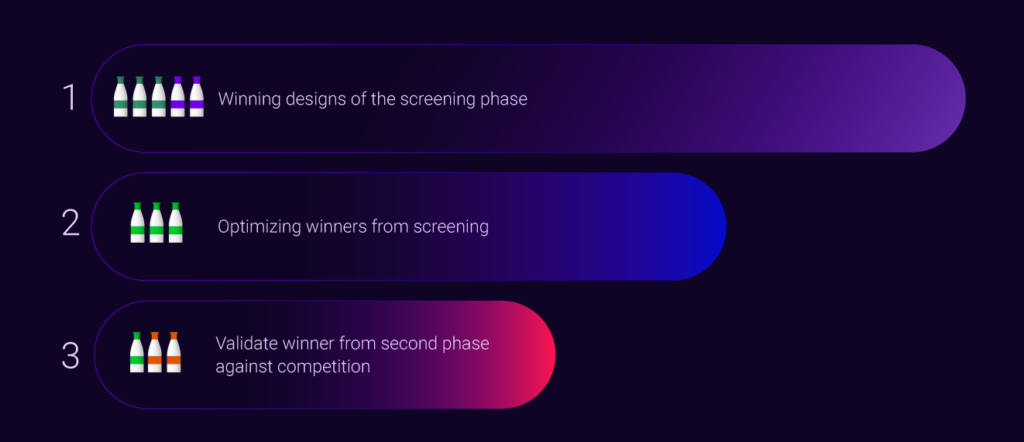

Amid the array of early-stage testing options — from traditional qualitative studies to a multitude of DIY and AI tools — making a methodology choice can be daunting. Personally, I find the behavioral mix approach, incorporating MaxDiff analysis, particularly promising for yielding effective results. At EyeSee, our team employs this method to pinpoint winners, offer recommendations for optimizing successful packs further, and contribute to finalizing subsequent iterations of pack design.

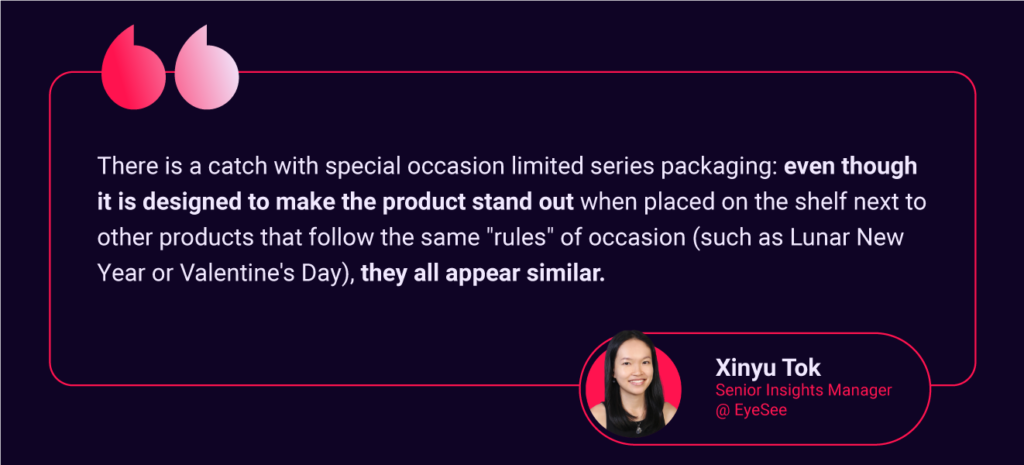

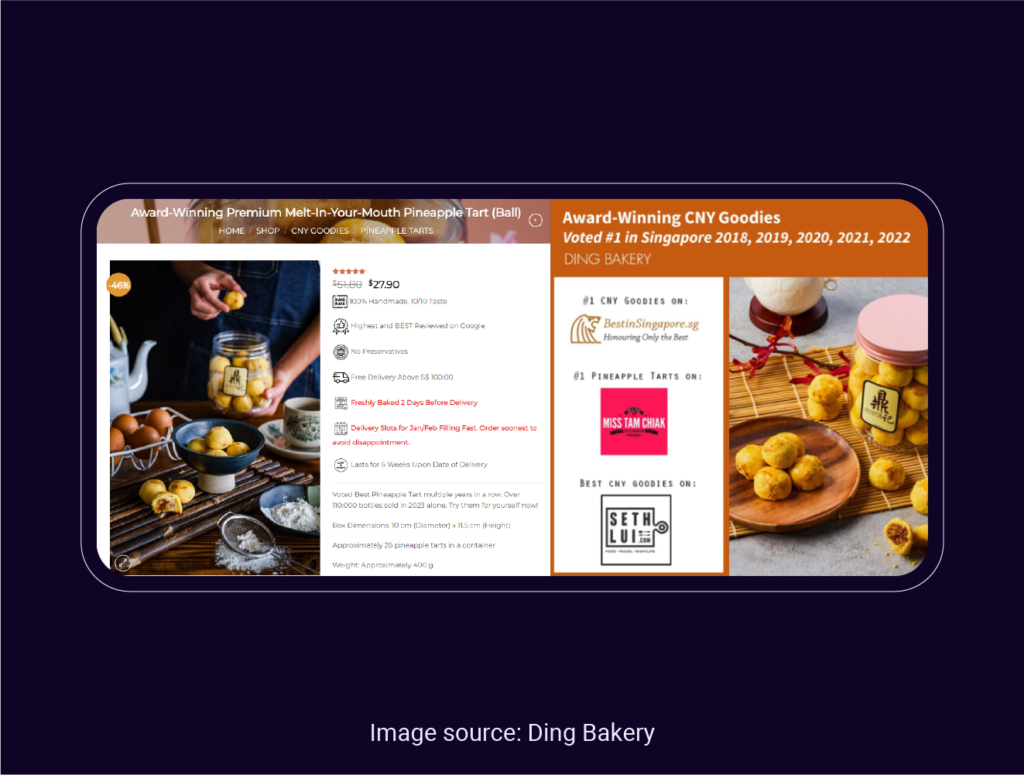

The ultimate reality check: Testing designs in simulated in-store scenarios vs in isolation

During our discussion on innovation, Shilpa mentioned one new product launch case that stood out as particularly intriguing. Initially, packs featuring a unique cap color and shape emerged victorious in early-stage and standalone assessments. However, when introduced onto (virtual) shelves and compared with others in the category, the tide had turned. A completely different design was ultimately picked for launch.

Centering on the importance of context, we explored the perspective of the challenger within the category. The “newcomer” on the shelf must distinguish itself more prominently to compete with the leader. The harsh truth is – what doesn’t stand out has little chance of being purchased. The evaluation of Clorox’s late-stage packs would have yielded vastly different results without testing in the shelf context. The intricacies of the store and real-life purchasing environments provide the most authentic and predictive insights into how the pack will perform post-launch. Reflecting on the whole collaboration, Shilpa shared:

In conclusion

Innovation in early-stage packaging design testing requires a delicate balance of collaboration, creativity, and strategic vision. By redefining conventional approaches, leveraging data-driven insights, and prioritizing consumer-centric design, you can instill confidence and enhance the prospects of a successful new pack launch. Moreover, the importance of testing within simulated in-store scenarios cannot be emphasized enough; a comprehensive evaluation of a new product’s potential is not complete without consideration of its pack design performance amidst crowded shelves and competing products.

For more insights and the story of Shilpa’s knowledge gained from not-so-successful new product launches, go to the full session recording that is available here.

Want to know more about pack optimization? Dive deeper and learn how to choose successful claims!

![[White Paper] TikTok First Content Guidelines for Powerful Ads](https://eyesee-research.com/wp-content/uploads/2024/02/Blog-cover-3.png)