By Iskra Herak, Sr Insights manager @ EyeSee

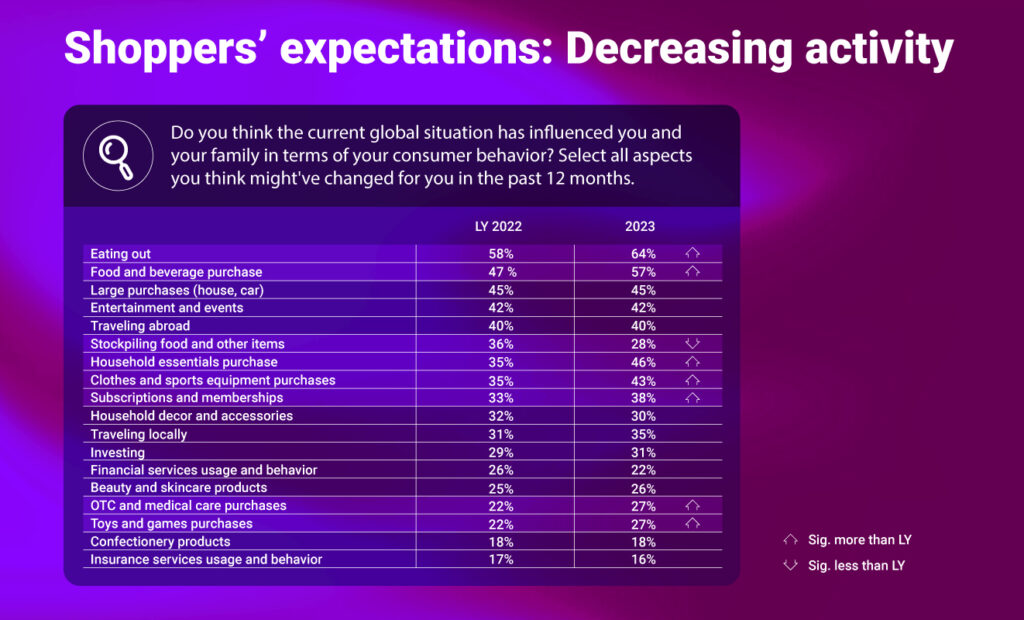

We live in a complex world where consumers face vast financial pressures; however, these pressures are felt differently across the globe. Our team at EyeSee looked into how pricing adjustment strategies affect shoppers; we’ve previously published the key findings for the US market, as well as the more detailed breakdown of four tested CPG categories. Now, let’s take a closer look at the results for the APAC region.

How does APAC cope with price increases?

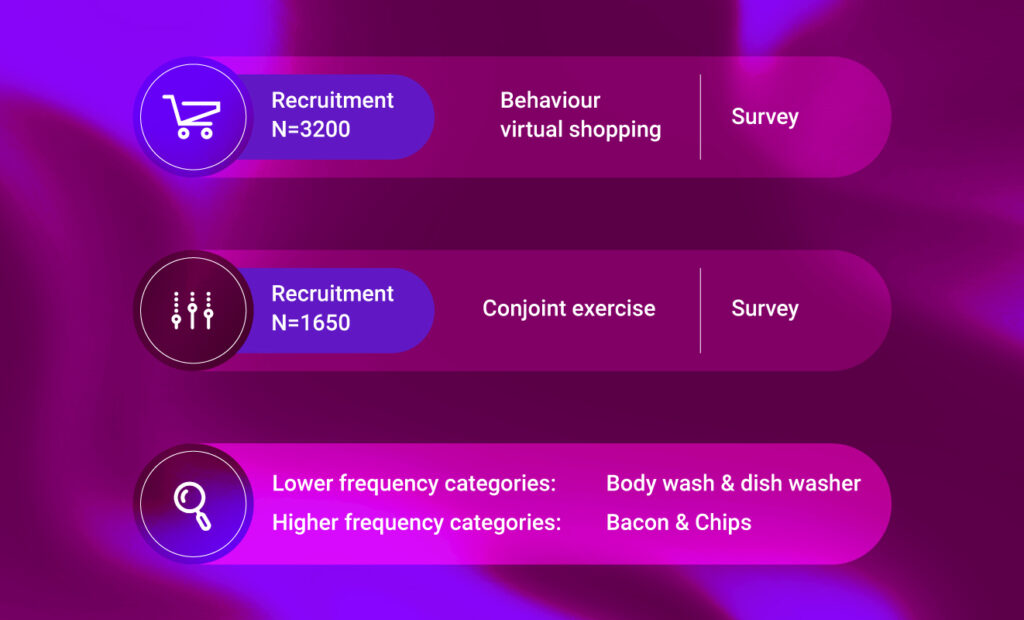

EyeSee has just wrapped up its first pricing study in this region to identify how consumer behavior is shifting when exposed to different pricing adjustment scenarios. In studies like these, it is important to test various categories, not only prices. The psychology of buying household items and the mindset of buying chocolate are completely different. The frequency of purchase depends on type of product category, even in the unstable times like these.

Using a conjoint exercise, we looked at four shopping categories:

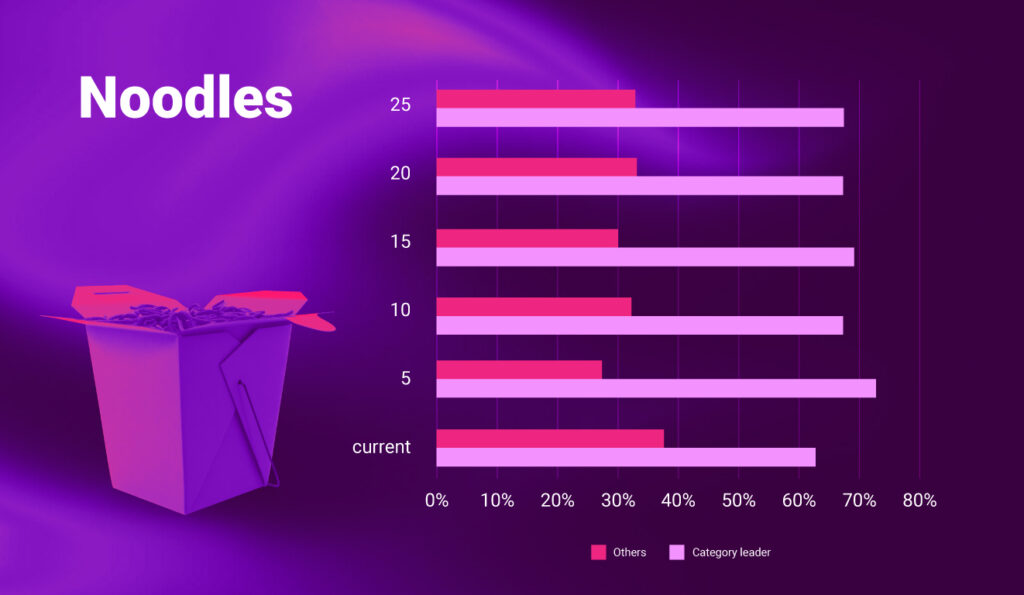

- 2 high-frequency categories – sweets and instant noodles

- 2 low-frequency categories – face moisturizers and antibacterial handwash

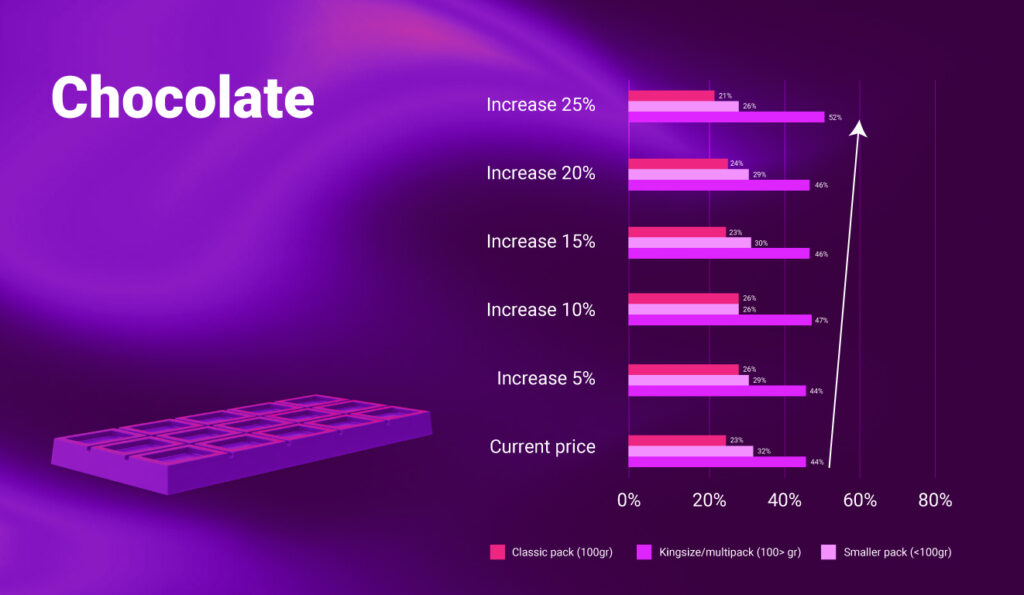

Consumers were shown different options for increased prices – 5%, 10%, 15%, 20% and 25%.

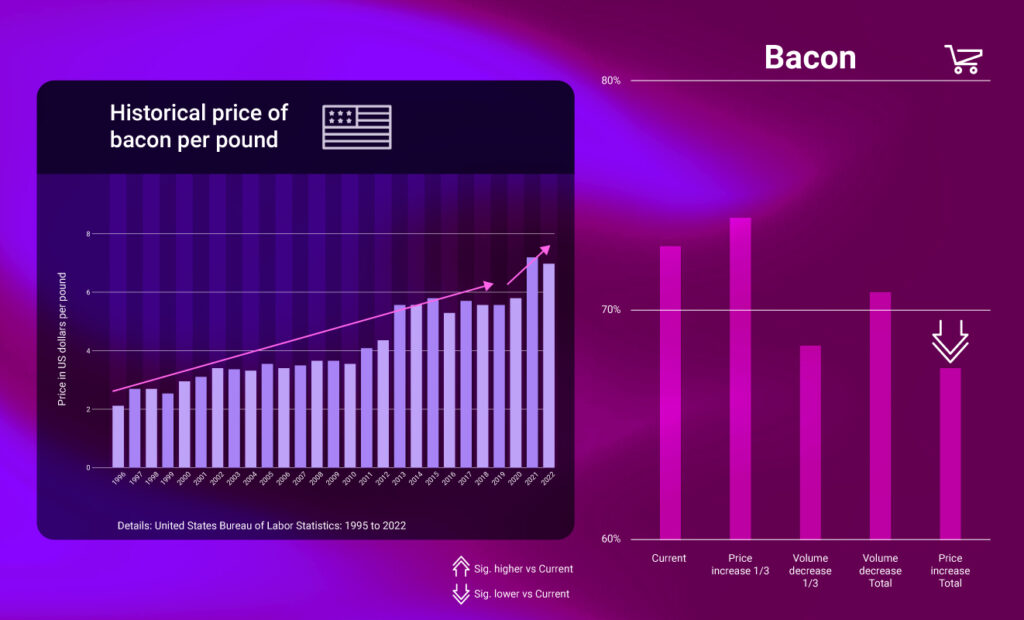

Different adaptation scenarios are possible, and while an increase in purchasing multi-pack and big size packaging can occur for household items, it is not what would be expected for indulgence products. While certain patterns and cycles re-appear in these situations, if you are a brand, it is important to stay in touch with the consumer through research and understand in which phase of the cycle they are at, at which stage the product category is and consider all those factors to best curb the pressures of the current situation.

Here are some of the main findings.

Back to the basics and functional

Regarding low frequency categories, as the crisis prolongs, consumers are very much looking to cover the basics and stick to essentials. It is important for brands to understand that because it is what consumers search for when they are choosing among a variety of face moisturizers and antibacterial handwash. Innovation and flavors won’t be deal-breakers – it’s primarily about simplicity, price, and necessity.

When it comes to noodles, a product in the high-frequency category, the price of the category leader does not significantly impact consumer purchasing behavior. Even if the price increases, the level of purchases remains relatively stable; consumers’ attachment to the leading and well-established brand is not at risk but rather reinforced. It serves as further evidence that consumer behavior tends to gravitate towards the fundamentals/basics during uncertain times.

Chocolate, however, is still worth it

In our pricing study we had a category of impulse buys, such as chocolates and sweets. We observed that the inflation of prices for the small packs of chocolates doesn’t decrease their consumption. On the contrary – it has increased. At the same time, there is a decrease of consumption of the king size and multipacks with the price increase. Our hypothesis is that it is probably because small-sized chocolates are treated as a small indulgence and something extra consumers don’t want to give up on.

Knowledge and skill bring calmness and optimism

In Philippines, around 1/3 of shoppers are price-aware and savvy consumers. They are focused on price, calculate the price per unit/kilo/ounce, and know where to find products on promotions. We found that they are very optimistic with regards to their future personal financial situation, employment security and job options, financial situation in the country, as well as the global financial situation. This is probably because they have a greater sense of control over their spending, so they feel like they know how to budget and don’t feel like they have to renounce anything. Inflation, if the gap between prices and the salary is not too big, won’t ‘break their spirit’ and will keep them spending and optimistic.

(Nothing) sweet about inflation

However, for most APAC consumers, the pressure of inflation is firm, and it affects their behavior a lot. It is highly important to understand the changes in their behavior, their new needs and how it combines to influence the industry. Unpredictable times call for highly predictive insights obtained throughout relevant tools and research.

Yes, there are many price-aware consumers who can deal with all this financial pressure, but the majority still can’t handle it. They won’t reject small pleasures and treats such as small chocolate, but that is the well-known lipstick effect. In psychology, the lipstick effect describes the observation that consumers will still tend to buy small luxury items even during an economic downturn. Cash-strapped consumers want to treat themselves to something that lets them forget their financial problems and enjoy modest delight and thrill. This can’t be applied in low frequency categories like face moisturizers and antibacterial handwash because rules are different here, and consumers want only the essential and basic.

Knowing all this, it’s crucial to understand your specific categories and how consumer behavior can change swiftly depending on the needs and products on offer

_____________________________________________________________________________________

Interested in findings from our pricing studies from the US and which categories have we researched? Read all about it here or you can check out the full webinar featuring Heather Graham (Director Client Service @ EyeSee), Sasa Radojevic (Sr Shopper Insight Manager @ EyeSee), and experienced retailer & Awarded 2022 Top Women in Grocery (TWiG) Raina Rusnak.