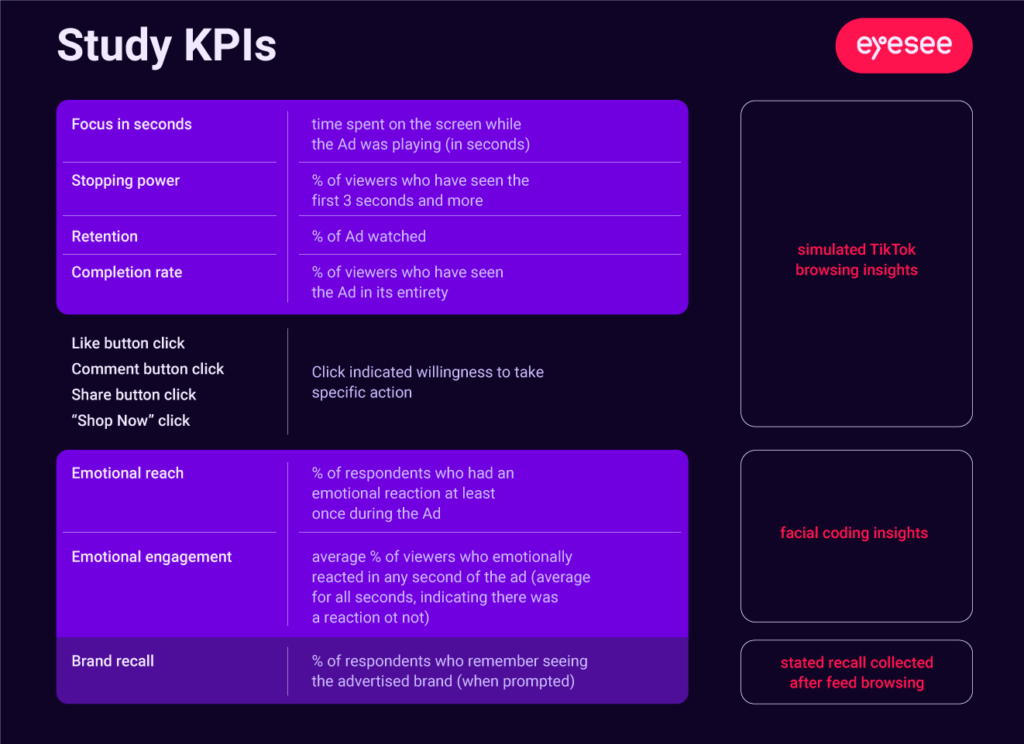

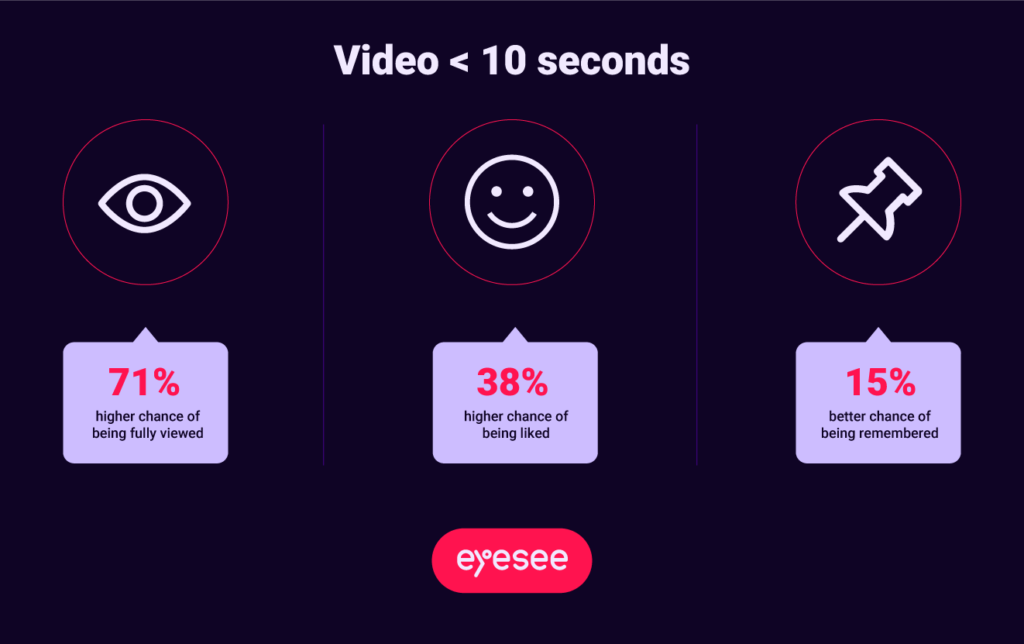

How do CPG products fit into today’s ever-changing, multi-touchpoint digital landscape? According to an EyeSee Global TikTok study, if a video ad features a CPG product, the brand is 32% more likely to be remembered, and TikTok has a significant inspirational impact on its users.

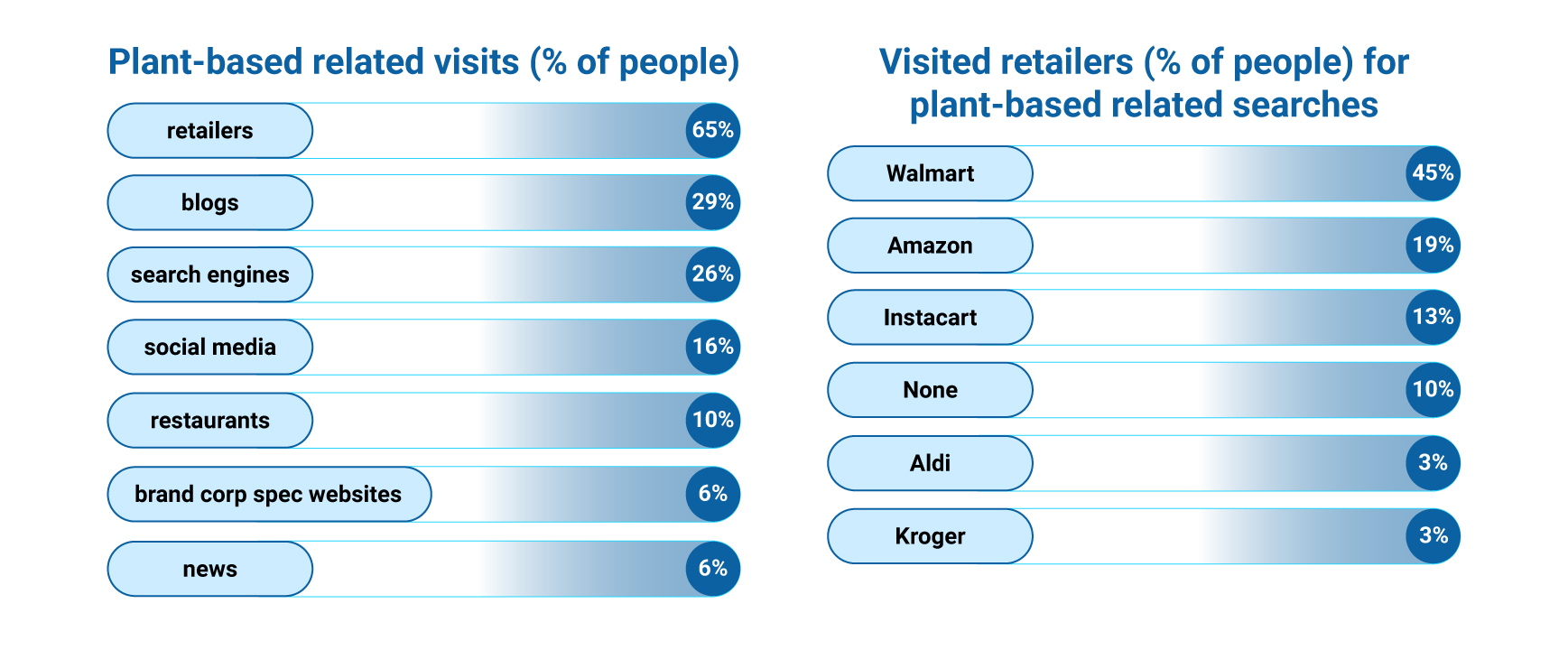

Despite this, buying CPG items online seems counterintuitive due to the high delivery costs. Retail media steps in to address this by aiming to enhance product awareness at the point of purchase. Yet, uncertainties persist regarding retail media’s scope, its impact on retailer-brand dynamics, and its long-term implications for omnichannel consumer behavior.

With all of this in mind, the latest Deep Dive episode featured Zlatko Popovic, Global eCommerce Commercial Manager at Barilla, who shared his thoughts on retail media and revealed the secret to Mulino Bianco’s successful e-commerce and omni-channel campaign. Along with Zlatko, our Digital Research Specialist, Mila Milosavljevic, debunked some common misconceptions about CPG and e-commerce based on her rich market research experience. Listen to the full episode here.

The Rise of Retail Media

With e-commerce platforms experiencing unprecedented growth, retail media provides brands with the opportunity to showcase their products directly to consumers while they are in the purchasing mindset. As Zlatko Popovic explains, retail media is becoming increasingly important in marketing strategies due to its ability to consolidate various parts of the consumer journey into one platform. This consolidation simplifies marketing efforts for brands and marketers, making it easier to create brand awareness and generate sales in a single place.

However, he also points out that some shortcomings of retail media include data governance issues and the evolving dynamics of brand-retailer relationships.

To mitigate these challenges, organizations need to invest in understanding consumer behavior across various touchpoints, including social media, and strike a balance between traditional and digital marketing strategies.

The Importance of Market Research

According to a survey conducted by Deloitte, 63% of marketers cite data-driven marketing strategies as crucial for success in today’s competitive landscape, highlighting the importance of leveraging market research to inform decision-making (Deloitte). By identifying trends, anticipating consumer needs, and refining messaging based on market research findings, brands can ensure maximum impact across all channels.

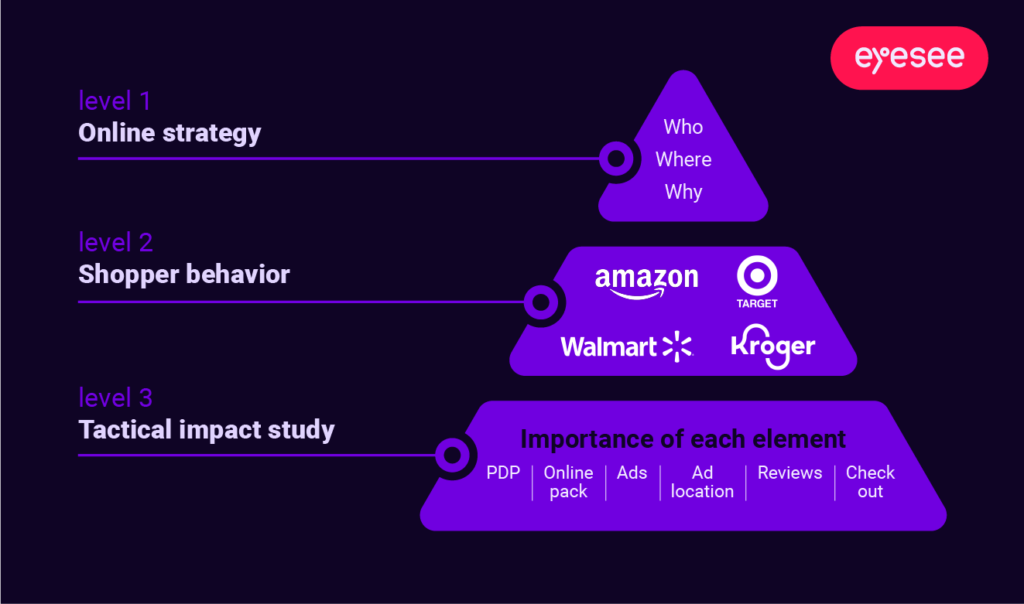

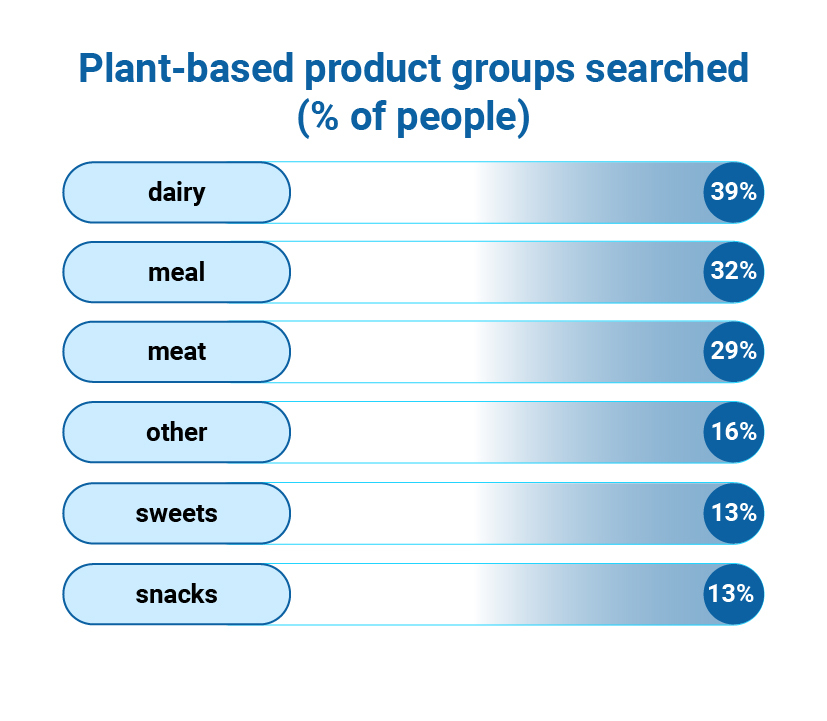

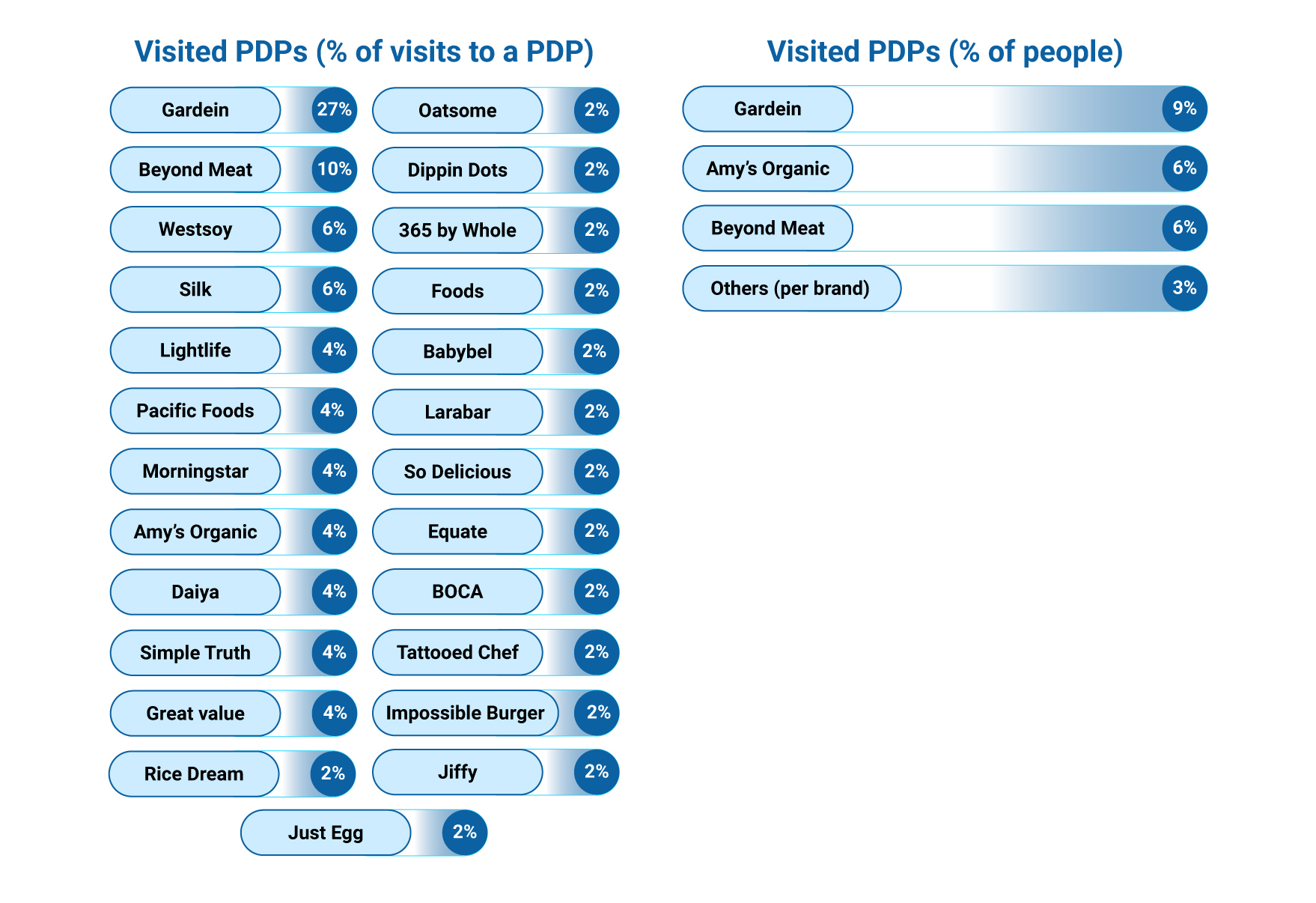

Mila Milosavljevic reminded us that when launching a product, manufacturers usually focus on in-store, designing eye-catching displays, shelf standouts, banners, endcaps, etc. in order to engage potential shoppers. But when it comes to e-commerce, product presentation is typically limited to fitting into the retailer’s current layout and relying on a generic description.

It is only natural to assume that similar testing tools and frameworks will be required when developing content and strategies for retail media, as we are essentially talking about an e-commerce retailer environment with even more space for product promotion.

Furthermore, Zlatko reminded us that market research serves as a common ground and foundation for quality relationships between retailers and brands in terms of category management and presentation in digital environments.

Case Study: Molino Bianco’s Gift Package Campaign

One notable example of successful omni-channel integration is the case of Molino Bianco’s gift package campaign. By analyzing product reviews and consumer feedback, Molino Bianco identified a demand for branded gadgets among its customers. Leveraging this insight, the company launched a series of gift packages tailored to different occasions, such as Christmas, Easter, and Valentine’s Day. This agile approach not only drove sales but also reinforced the brand’s presence across multiple touchpoints, from e-commerce platforms to traditional retail outlets.

“When that happened, everyone began to view the Mulino Bianco project not just as an e-commerce activity, but as a full marketing initiative. Consequently, various brand teams began incorporating similar initiatives into their annual plans, specifically targeting e-commerce to align with the marketplace proposition effectively.”, Zlatko Popovic, Global eCommerce Commercial Manager at Barilla

Conclusion

In conclusion, the integration of retail media and market research is essential for achieving a strong product omni-channel presence. By harnessing the power of retail media platforms and leveraging insights from market research, brands can create personalized experiences that resonate with consumers across all touchpoints. In an increasingly competitive marketplace, mastering omni-channel integration is key to staying ahead of the curve and building lasting relationships with consumers.

Eager to learn more? Here you can read all about Understand online pack shot behavioral testing.