Written by Mirna Djuric, Innovation Director at EyeSee.

Get access to the full plant-based study report at

[email protected].

Vegan-friendly products are gaining popularity despite the almost equal and opposite force of the increasing popularity of keto and other high-protein diets. How will we combine the two? Cue: alternative protein.

We’ve seen sales of alternative protein products increase steadily over past years, but how is the category developing – are vegans finally getting options for a variety of diets or are regular meat eaters dipping their toes into vegan foods?We ran a passive tracking study following the online behavior of 75 meat eaters over a period of 3 months in the United States. With their permission, we recorded their browsing histories and selected food-related online behavior. Here’s what we found.

More about Passive Tracking:

Passive Tracking is the first step in the holistic understanding of the consumers’ path to purchase. This exploratory phase provides us with valuable insights into consumers’ natural behavior (not claimed) when searching the category and brands online. After consumers’ consent, we are able to analyze respondents browsing history in the past 30, 60, or even 90 days. Passive Tracking provides answers to some of the most common client questions related to category online behavior:

- Which touchpoints are most frequently visited when searching for category online – retail websites, expert websites, brand/corporate websites?

- What is the typical number of visits?

- Where do visitors come from (which websites)?

- Where do they land on the retailer’s website?

- What are the most relevant search terms and queries in the category?

A whopping 43% of shoppers are interested in plant-based

That is to say that plant-based products are a far cry from being a specialty food intended for vegans, but quite the contrary – it is an everyday food choice among many others regular consumers make. To confirm this finding, we asked 1000 respondents directly through a questionnaire whether they have tried these products and if they are willing to – recording a similar result, we found that ~35% of consumers have already purchased and consumed plant-based products, while another 40% are willing to do so. Great potential is still out there to grow the category further. Given our findings, there are reasons not to keep plant-based products anymore in specialty aisles, moving them to the regular aisles next to their animal-based counterparts would benefit consumers and brands alike.

Speaking from a climate change perspective, animal products are among the top 3 culprits contributing to greenhouse gas emissions, and after all, we don’t need a handful of people doing the change completely, but we need billions doing it partially – these findings suggest we may be on the right course.

A reason to curb optimism: plant-based related online behavior, albeit widespread, is still under around 1.5% of all meat and food-related visits these consumers had. This is quite a small percentage that will hopefully grow in the future, but for now, we can consider this a trial behavior among meat eaters.

Shoppers both learn and buy the category at the same place – retailer website

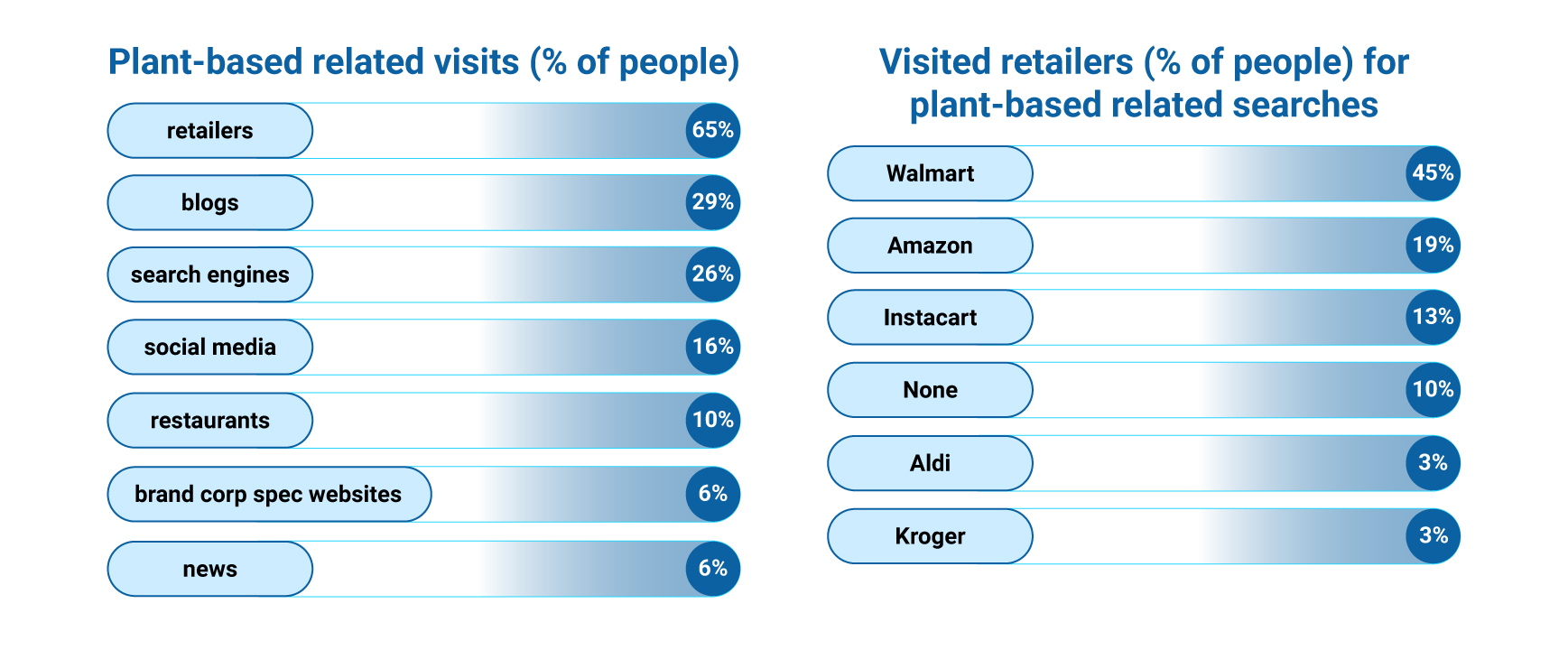

Retailers’ websites are the most visited addresses related to plant-based products. 65% of the sample we followed visited an online retailer in search of vegan/plant-based products, with little research beforehand or after the visit. Retailers’ websites are probably very good at both informing the consumer and selling the product at the same time. If brands are looking for where to start reaching out to shoppers, their own PDP on popular retailers is already a good choice.

Around a third of the sample visited any food-related blogs searching for information on plant-based alternatives, and even fewer went through search engines like Google or Bing. Given the nature of visited blogs (most of them recipe blogs), consumers most likely encounter a product on a retailer’s website and search for recipes and inspiration on blogs.

Restaurants are still growing in representation, with only 10% of the plant-based visitations, but it is comforting to know they are being explored for plant-based options too. We may expect this will grow as the category gains importance.

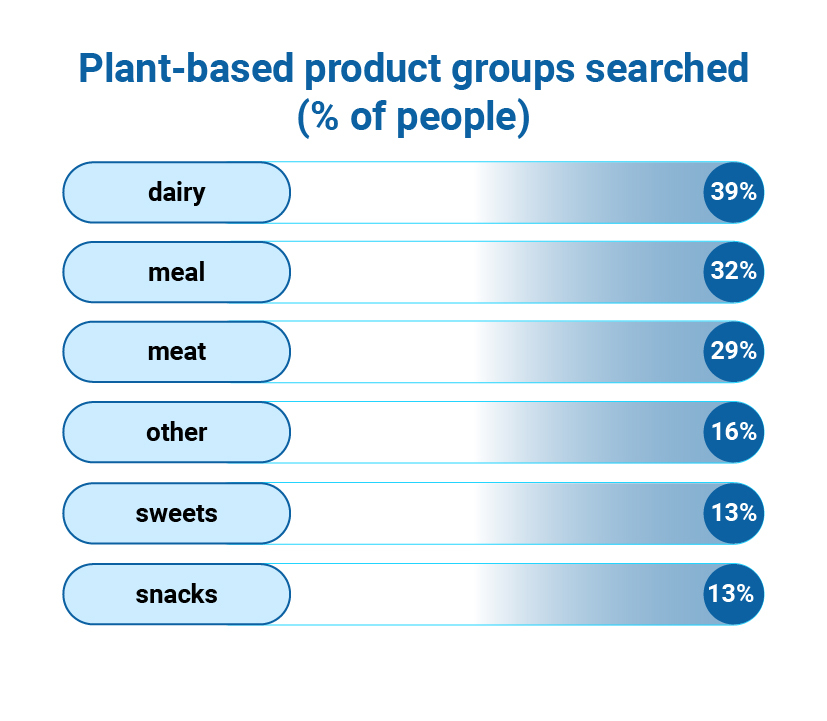

Dairy is still king in the plant-based food category, but full meals out-beat meat

Meals like soups, chilis, curries, and burritos are even more frequently searched for than meat substitutes, which may be an effect of familiarity. These are still majorly the same meals we’re used to with one or two ingredients switched out. A plant-based burger patty, sausage, or chicken nuggets may be expected to have a too different of a flavor, so it may be saved for latter trials.

Dairy is still the most frequently searched and a good entry point to the category. This may well be a spillover from brick-and-mortar, where dairy plant-based products were the first ones to earn a spot in regular aisles. From what we see, they carved themselves a space next to animal dairy in consumers’ minds too.

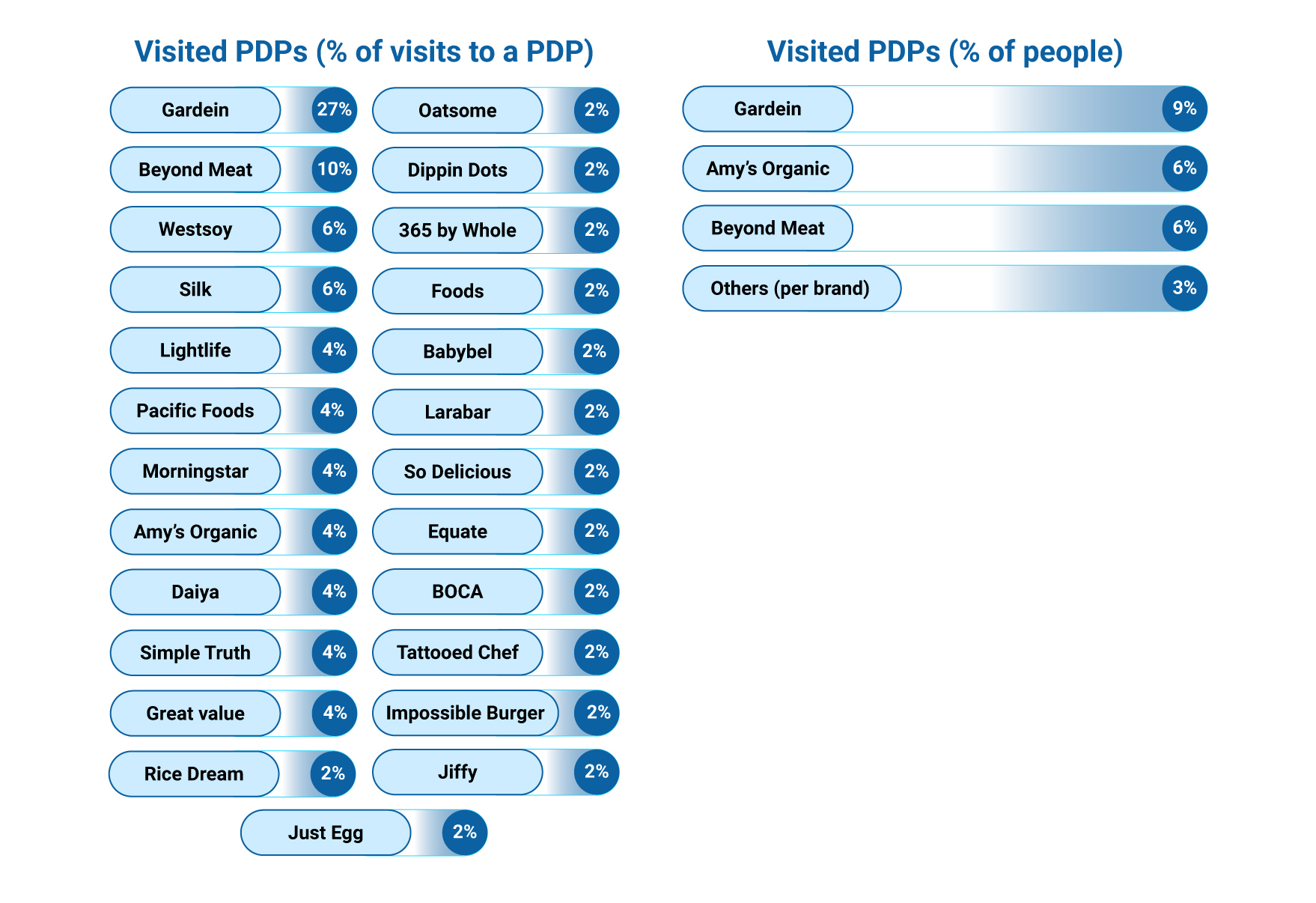

Mainstream brands should step up the plant-based game

Plant-based specialty brands are still the most popular, there is space for mainstream brands to innovate in plant-based options.

When looking at which PDPs shoppers visited for plant-based products, the top of the table is still reserved for native plant-based brands. Not as unexpected, keeping in mind that although many brands invest in plant-based products, not many of them are mainstream USA brands, according to the FAIRR report.

For brands considering entering the category with new products – think about known (familiar) products where only one ingredient is animal-based. Personal health is still more important than environmental impact (based on researched topics in the sample), so when it comes to communication, it should be emphasized first.

And, of course, if unsure how will the targeted audience react, testing is the way, regardless of the product’s development stage. Testing can help while still prioritizing ideas, selecting concepts for further development, and of course, when the product is fully developed, including packaging.

In conclusion

We can safely conclude baby steps toward the popularization of alternative protein options have been made: a significant portion of people have already tried them together, with a big portion having a low barrier towards the category. This gives a good reason for developing more plant-based options targeted at mainstream shoppers, the whole category is ready to exit specialty aisles as well as decrease the premium pricing it often encompasses.

There is a way to go still: although wide, interest in plant-based protein is not deep, which we can expect to change in the future as options grow and more mainstream brands innovate in the category.