By Saša Radojević, Sr Shopper Insights manager at EyeSee

With almost 2/3 of households in the US living paycheck to paycheck, the additional pressure of inflation pushes consumers to prioritize, rethink and, in some cases, give up on purchases.

EyeSee has just wrapped up the second wave of the pricing tracker in the US to identify how consumer behavior is shifting when exposed to different volume and pricing adjustment scenarios.

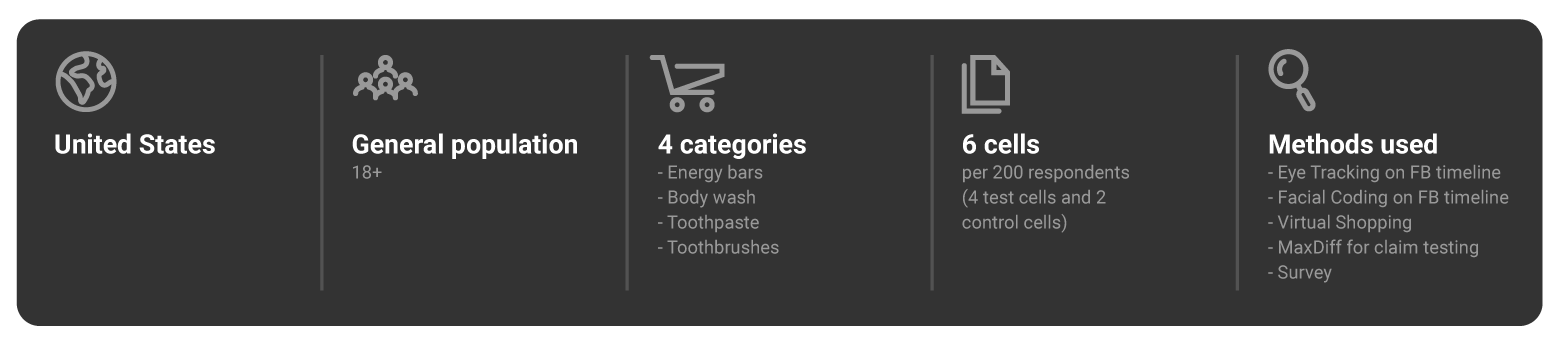

The study included two separate samples to gain an in-depth insight into consumer confidence. One group (a sample of 3200 individuals) was exposed to virtual shopping exercises, while the other sample completed a conjoint exercise (a sample of 1650 individuals). Both surveys aimed to identify new patterns of behavior and understand shoppers’ perspectives on the current situation.

To understand the retailer’s perspective on the matter, check out our latest Quirk’s webinar.

So, what buying behaviors have changed over the last year?

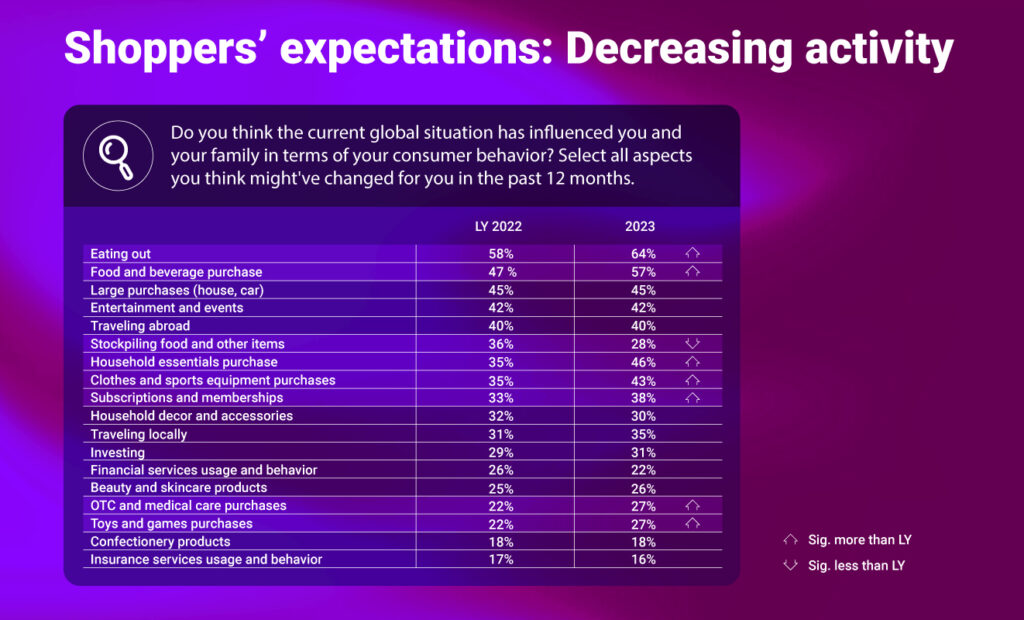

In the first wave of the tracker that was conducted mid last year, we asked respondents to forecast how they plan to buy in the upcoming period of six months.

In most categories, such as cosmetics, entertainment, traveling, finance and insurance, and other long-term investments, the behavior and predictions align well. Surprisingly, this time last year, over a third of respondents claimed that they will be stockpiling food and other items over the next six months, yet fewer did so.

Eating out has been affected more than consumers predicted a year ago, as well as the overall purchases of food and beverages. This makes sense when paired with the stockpiling trend among over 28% of respondents, which indicates they are very much looking to cover the basics and stick to essentials.

When it comes to predictions for low frequency categories like household essentials, clothes, and sports equipment, as well as subscriptions and memberships – these have all been affected to a greater extent than predicted a year ago.

Is shrinkflation your best move?

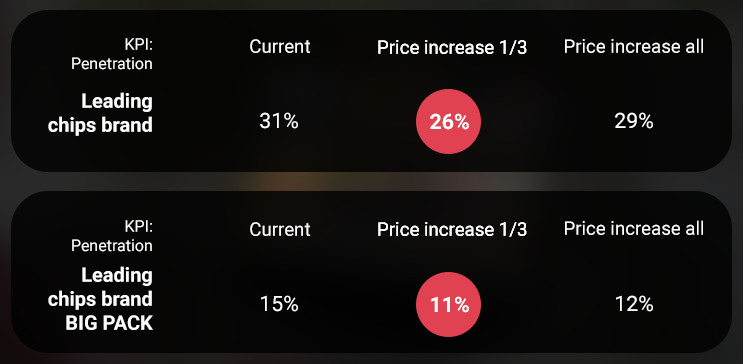

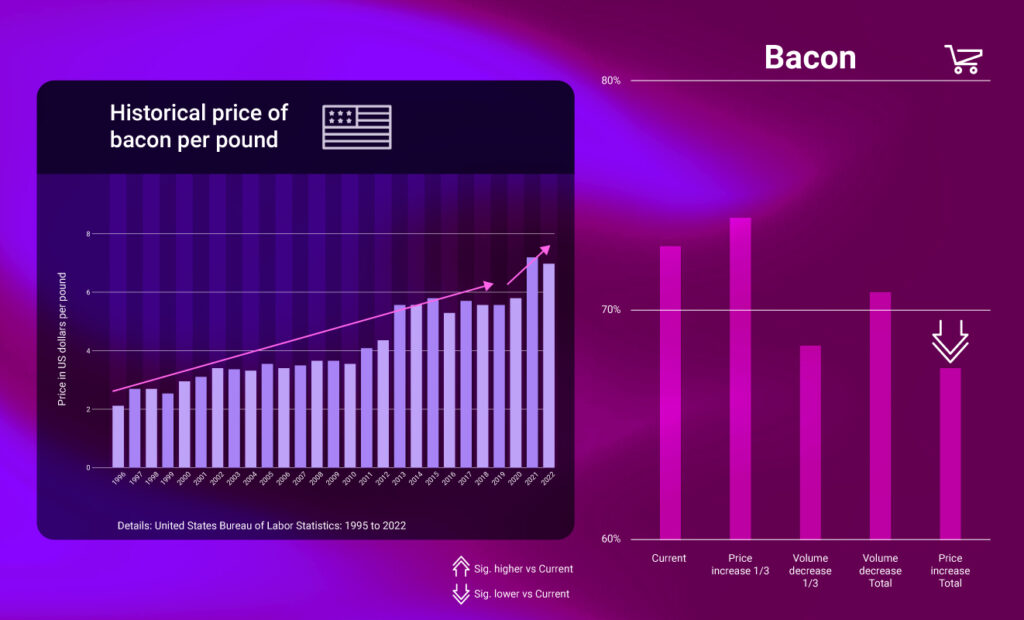

Same as last year, we investigated two lower frequency categories (body wash and dishwashing) and two higher frequency categories (bacon and chips). And within these exercises, consumers faced different scenarios.

- In virtual shopping, the range of choices included the current pack price and size, increased prices of one third of the shelf and then the entire shelf, but also a decreased pack size of 1/3 of the shelf and then also the entire shelf.

- And in conjoint, they were primarily faced with different price increase scenarios ranging from 5% increase all the way to 25% increase, but also a size reduction of its tax by 20%.

When looking at conjoint, volume decrease scenarios have low impact on respondents’ behavior. However, virtual shopping data tells a different story. Specifically, if we zoom in on the price sensitive segment, we can see that shoppers are extremely sensitive to any type of shrinkflation, especially in the body wash category.

Chips and dish wash sales are also affected, but primarily when only 1/3 of the packs on the shelf are reduced in size.

Thou shalt not pass price thresholds

Out of four categories we looked at, Bacon is the one impacted the most particularly when the whole category takes a price increase. In our research, we are using today’s pack sizes and prices, however it is important to consider the historical record of the bacon category fluctuation over the last couple of decades to fully understand the shift.

Last year, our study showed little to no impact, presumably because the prices skyrocketed in 2021 and 2022; the consumers were desensitized. However, this year in the scenario where the price was increased by another 25% on top of the already high price, data shows that the consumers walked away from the category at this point.

For each of the categories, there are thresholds – and for bacon, we are nearly there.

Want to know more? Check out the full webinar featuring Heather Graham (Director Client Service @ EyeSee), Sasa Radojevic (Sr Shopper Insight Manager @ EyeSee), and experienced retailer & Awarded 2022 Top Women in Grocery (TWiG) Raina Rusnak.