As reports of the plunging consumer confidence continue to emerge in the developing global situation and inflation becomes a challenge across the world – the critical question for marketers and businesses is: what will be the impact on shoppers’ behavior? In a comprehensive study, our team took a closer look at the shifting sentiment in new circumstances using a tech-driven approach leveraging virtual shopping.

This is part two of a three-part series on global inflation and its impact on consumer confidence – check out part one and get the full report!

How did we approach this complex question?

The first wave of this study focused on the US market – but stay tuned for EU results! In order to gain an in-depth insight into consumer confidence, the study included two separate samples. One group was exposed to virtual shopping exercises, while the other sample completed a conjoint exercise – both followed by the same survey aimed to identify new patterns of behavior and understand shoppers’ perspectives on the current situation.

When the prices change, consumers behave differently

As inflation brings on new challenges for both businesses and consumers, many brands across industries are faced with pressures to change parts of their businesses in order to combat the effects of the uncertain economic environment. One such strategy is increasing their prices – but this comes with certain risks. For instance, if just some brands increase their costs and it is possible for shoppers to compare the price tags on the shelf, we’ve seen that the most price-sensitive ones walk away from the shelf. However, when the whole category increases the prices, comparison shopping makes the differences in pricing less obvious, so consumer behavior remains consistent. Another factor to keep in mind is how frequently a product is bought – and the changes across these categories are not to be amiss.

Low frequency category: Body wash and dish detergent

A noticeable trend for the low-frequency category is that shoppers tend to opt for a smaller package within the same brand. So, when deciding on a body wash and dishwashing detergent, they do stick with a brand they already trust but choose smaller volume packs. On top of this, the findings uncovered that the most significant drop in demand for this category was exactly with the bigger packages from the best-selling brands.

What is important to remember here is when the best-selling brands are the ones taking the price increase, they stand to see the impact the most – but here the good news is that pack size can still play a role in consumer decision-making.

High frequency category: Bacon and Chips

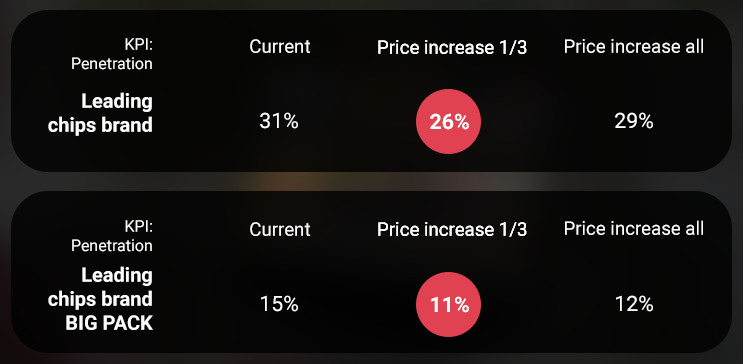

What happens when the prices increase for the products that get purchased more frequently? We have noticed a general switch towards alternatives and exploration of different brands that didn’t change the costs. So, when talking about chips, most shoppers are quick to jump to a different brand altogether – and since there is a great variety of these products, they’re easily replaced. Therefore, price increase leads to a significant drop in brands’ penetration when 1/3 of the brands increase

Another reason for the change in consumer behavior might be that the prices are more aligned across the category, so the price increase is easily noticed (3.99 or 3.59 as the standard price).

Interestingly, the bacon category didn’t see ANY changes – there was no sensitivity to price increases, no switching between brands and the best-sellers remained the best, and some performed even better when the prices jumped.

Volume changes are risky business

So, if the price increases, shoppers tend to go for the smaller packs. But, does this mean that brands should decrease the sizes of their products? Well, this tactic can be risky in the long run since consumers might feel tricked if not properly communicated.

But there are 2 scenarios where it could be done – if all the brands in a category align and decrease the volumes at the same time OR there is such variation across the category that it’s really not possible to compare the different sizes easily. Overall, volume decreases are another strategy brands could leverage to tackle times of crisis, but keep in mind that consumers become more sensitive to any changes during these periods, so decreasing the volumes without transparent communication could lead to frustration.

Shoppers would rather skip buying than go for Private Label

Even when high inflationary pressures do not affect the everyday life of consumers, the biggest challenge brands have to deal with is remaining competitive – especially with the growing penetration of private label brands. With the appealing prices combined with the on-par quality of shopper-favorite products, private label packs have been making their way into consumer carts more and more over the last years.

Now, in the changed global setting with higher price points, it would be expected that consumers would gravitate even more towards PL brands that are friendlier to their wallets. However, as mentioned above, shoppers actually prefer to stick to the brand they already use rather than trying to find alternatives and switching to a completely new private label product.

This is particularly true for the low frequency category – since consumers buy these less regularly and the tested products were for personal care, it makes sense that they want to continue to buy the ones they trust and know perform well. More good news for brands is that the findings showed that sales for the private labels actually stay consistent throughout different price increase scenarios – meaning there is no migration of shoppers!

If you want to hear how experts at Kraft Heinz are navigating the crisis, make sure you check out the entire webinar: