TikTok is an undeniably influential social media platform with significant untapped potential for sponsored content. Following the pandemic, our habit of using TikTok remained strong. The app enjoys one of the highest user retention rates globally. An incredible 81% of users say TikTok videos influenced their recent purchases. That is why it is becoming increasingly important for brands to understand how to create effective ads that resonate with their consumers.

According to our most recent two-wave global study, we discovered that 71% of TikTok users stop and watch the first three seconds of the video and that 56% of each sponsored content is seen on average. All of this is supported by the fact that the ads are liked by 73% of TikTok users.

These figures show that sponsored content has every reason to thrive in TikTok’s digital environment. However, brands are still not using their full potential. This study not only invites you to use TikTok to empower your brand, but it also gets deep into what you must keep in mind while doing so. If you are interested in getting an expert walkthrough of the study, write us at [email protected]

Methodology

As previously stated, we tested 60 ads from 20 brands across markets and industries such as FMCG (Fast Moving Consumer Goods), Beauty, Insurance, Fashion, Technology, Automotive, Retail, etc. TikTok simulations, standalone ads, and surveys were tested among 7280 respondents.

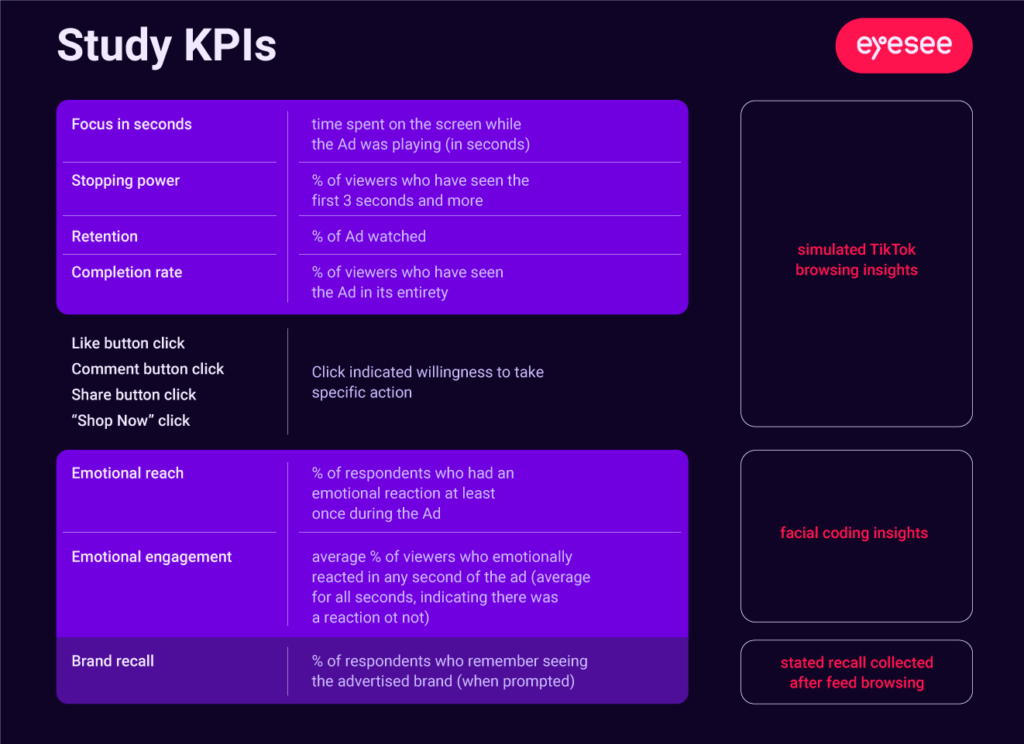

This research is built on the following key pillars:

- Ad stopping power (tested the ads in a simulated TikTok environment that provided us with browsing insights)

- Ad retention (tasted by exposing respondents to a simulated TikTok environment)

- Ad emotional reach (tasted by exposing respondents to standalone ads and utilizing face coding methodology)

- Ad likability (tasted by exposing respondents to standalone ads and utilizing face coding methodology)

- Brand recalling (to learn % of respondents who remember seeing the advertised brand when prompted, we used the survey method)

The challenge of TikTok advertising

Why don’t brands use TikTok more? This is the imposing question that arises when we look at the numbers that show the untapped potential. On one hand, we have the answer that for brand managers, it is hard to follow the ROI once they invest in TikTok ads. They are unsure how to follow the path and make a clear connection, or better to say, they are unsure how to follow the path to purchase from the TikTok ad to the shopping cart.

On the other hand, even when clarity in that field is gained, the questions of how to approach strategy and what works best remain. There are questions about what will work better – the native approach or strongly branded videos that will also work on other platforms; what is the reach of animation as the dominant style; and is co-branding the way to more followers and engagement or the way to poor brand recollection?

This study answers all those questions and beyond. For example, animated video ads, those containing any kind of computer-generated imagery, will improve brand opinion by 23% and increase brand interest by 19%, while elevating the positive emotions about the brand by 20%.

However, brands must be careful; there is a chance that they will be seen as less informative than conventional videos if the message and narrative in them are not constructed carefully.

The golden rule for unlocking the untapped potential

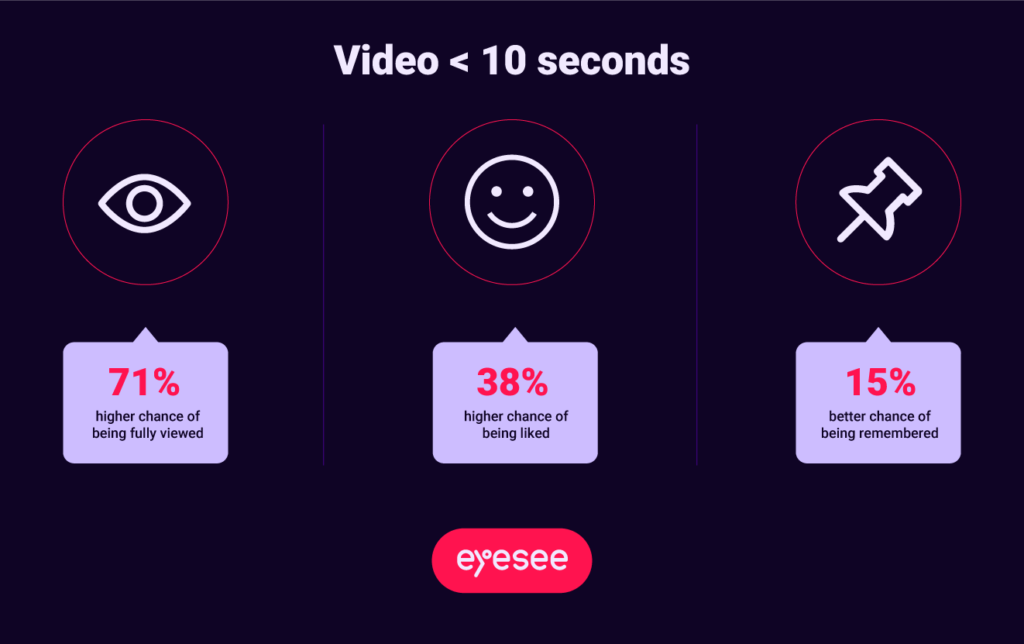

What is great about this report is that it contains a lot of simple facts that must be considered in future ad planning. For example:

- If the ad lasts up to 10 seconds, it has a 71% higher chance of being fully viewed.

- A video that lasts up to 10 seconds has a 38% higher chance of being liked.

- If the brand lasts up to 10 seconds, it has a 15% better chance of being remembered.

This is an example of an insight finding that makes a strong recommendation that is universal around the world. However, in this report, there are far more complex recommendations that necessitate a thorough examination of both specific brand values and the TikTok environment.

All of this is only the beginning. If you want to learn more, send an email to [email protected] and we will provide you with a video expert walkthrough of the study. Not only will you get the big picture and the future framework for making strategic TikTok ad planning decisions, but you will also be able to formulate specific questions for your specific pain points, which we will gladly assist you with.

Request access to

TikTok creative study findings!

Eager for more? Read the blog about replicated feeds for authentic behavior here.

By

By