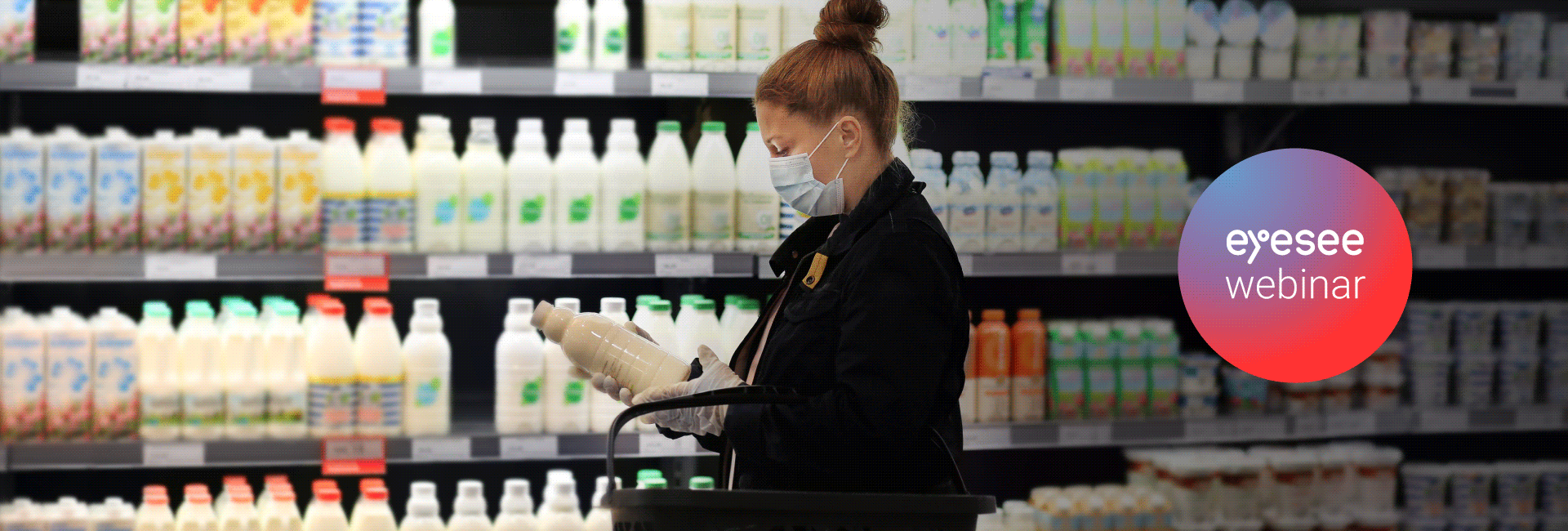

On a supermarket shelf, the interests of retailers, manufacturers, and consumers converge in the most tangible way – a consumer settles on one out of hundreds of different products at hand, and a decision is made before you know it. But how do you ensure you really understand what happens in front of the shelf? Data about end sales does too little, too late to explain the decision. On the other hand, surveys that promise prediction by relying on stated purchase intent and claims of future behavior are about as reliable as rolling the dice. Enter Behavioral Decision trees.

Decisions abound in a retail environment, leaving numerous questions unanswered by traditional research methods. What happens when your consumers have to make a trade-off in shopping? Do they stick with your brand if their go-to product is out of stock or do they switch to a substitute product easily? Which attributes are exchangeable, and where does their loyalty lie? Most importantly, how do you learn about all this?

The answers to these and many other questions are found in a Behavioral decision tree. With a new behavioral framework, this revamped tool delivers plenty of data about actual decision-making. Virtual shopping ensures respondents are making decisions in context and with thousands of real shoppers, you are delivered reliable and stable data to base business decisions on.

Behavioral decision trees – remote, scalable and highly predictive

Decision Trees are used as a graphical representation that helps manufacturers and retailers understand how consumers make decisions in front of a shelf. They provide defined product hierarchies and help category segmentation, simplify the shopper experience and maximize the entire category sales. But here’s the kicker – what differentiates the behavioral is the addition of virtual shopping environments.

There are two key benefits of going behavioral and online – putting shoppers in context via virtual shopping environments, instead of relying on surveys, ensures real insights into actual in-store behavior. And secondly, a thing which is extremely relevant during the pandemic, but also beyond – not having to use face-to-face interviews but running the study with thousands of shoppers online, making decision trees scalable. This way, your business decisions are based on actual shopper decisions, and not on what people say they will do.

Why is virtual shopping the MVP of research?

Basing your product decisions on stated measures turns out to be a risky business. We ran a meta-analysis on over 35000 respondents from dozens of projects across FMCG industries, and compared survey results to virtual shopping data. Considering its high correlation with Retail Audit Sell-out Data (0.8) and the fact that it puts consumers in the right context, we used Virtual shopping as an external measure of the reliability of claimed future behavior. In a nutshell, the results argue that it is extremely important to be careful if you are making business decisions based only on stated purchase intent – whether top box or top2box, as both have some sort of error in them.

So, how unreliable are surveys?

Well, we calculated the error margins and the findings indicate that the purchase intent measure is incredibly unreliable – on the brand level, the error was as high as 71% for T2B. On the SKU level, the overestimates are even more extreme at 486% for T2B and 217% for TB.

Mapping out the pain points and opportunities in a category

The Decision tree output shows which product attributes are the ones that shoppers aren’t willing to sacrifice when faced with an out-of-stock situation – these are the ones that are the least substitutable. What this means for retailers and manufacturers is that they need to follow the tree to create corresponding (visual) blocks in the planogram. For the top three levels of the tree, it is a must to develop clean blocks that are easy to find on the shelf. The tree levels dictate how substitutable a product is for a shopper. The higher the level, the less substitutable the product is.

The 4 types of shoppers you are dealing with

There is a simple but effective framework for interpreting the decision tree results and identifying consumer segments. Based on our studies, we identified 4 types of shoppers when it comes to brand loyalty – instant switchers, switchers/quitters, risky shoppers and loyal ones!

When you know how the sample spreads across each of these 4 types of consumers, you can start to think about how to assist their shopping and ensure your brand is not overlooked due to a bad planogram. Furthermore, it opens an opportunity to understand whether you have a chance as a replacement for your competitor, where do these buyers come from, and what triggers them to make the switch. A poorly executed shelf is frustrating and can affect sales.

Getting the full picture with a Brand Gain & Loss Analysis

Another valuable output that can be included is a Brand Gain & Loss Analysis – which provides a proportion of shoppers that switched from your brand to Competitive Brand X or who switched from Brand X to your brand, pinpointing when it happened during the shopping process. For an even deeper understanding of the process behind purchase decisions, the stated importance of the attributes, brand recall, dominant occasions and missions as well as ease of shopping and shelf organization are included in the analysis. This allows for a 360-degree view of the shopper and the shelf, by using both implicit and explicit methods in a single study.

The many applications of Behavioral decision trees

Behavioral decision trees are a versatile tool that really helps navigate the complexity of category management, but its benefits spill over to other areas as well. For example, they are most commonly used for shelf optimization and planogram creation. Then, identifying gaps in assortment and looking for areas that are hiding some innovation opportunities. Learnings from these studies can be used as a great source of input for building a communication strategy – since they can uncover relevant purchase motives – for both in-store prompts and on-pack claims. Finally, they aid in distribution optimization – by identifying distinct segments that drive loyalty and require full-time availability at the retailers.

The Behavioral decision tree FAQs

- Why do decision trees require such a large sample size?

In order to obtain more reliable and stabile insights, the entire tested category and all the relevant product attributes and their levels such as brand, price, type of pack, size of pack, functionalities, and sometimes category-specific attributes should be represented! The only way to ensure all market segments are covered exhaustively, bigger samples are needed! It also depends on the research question, meaning sample sizes can vary from 1000 to 3000 respondents.

- How are categories defined in behavioral decision trees?

A category is defined by how shoppers group products based on their needs and product interchangeability. For instance, a common definition for cola and non-cola soda drinks should be the “carbonated soft drinks” category because shoppers could switch between cola and orange soda but would not logically use milk to satisfy the same need state. So precision is key when it comes to choosing and deciding on the right boundaries of the category in order to get the most relevant insights about the entire competitive landscape across it.

Interested in learning more? Get the full meta-study findings on how surveys compare to virtual shopping and check out the behavioral decision tree demo!