‘Eco-friendly’, ‘zero-waste, ‘100% recyclable’ – we’ve all seen them on that small section of supermarket shelves, but do these claims have the power to impact consumer behavior?

This is the second part of the comprehensive study on building sustainable yet competitive products that get picked out on the shelf. Here are the upcoming parts that will be published in the following months:

Part 1: The green horizon: An intro to the green buyer and how to measure eco behavior

Part 2: Walk your talk: Strategies for choosing your sustainable product claims wisely

Part 3: Social media impact: How much does social media content impact actual shopping?

Part 4: Virtual shopping: Why some categories are leaders in change, and how to become one

If venturing out to the eco-market, knowing your core audience is a must. In part one, we tackled the 3 shopper segments and what drives their (un)willingness to buy sustainably. But beyond understanding how these groups shop and what their incentives are – it is essential to understand how to effectively communicate your product to each segment and help the fight for ecological issues. This is where product claims come into play – they are great real-estate to not only communicate your product’s benefits and in a way negotiate the purchase, but also to directly state what exactly it is doing to make a green impact.

Clear claims for the big win

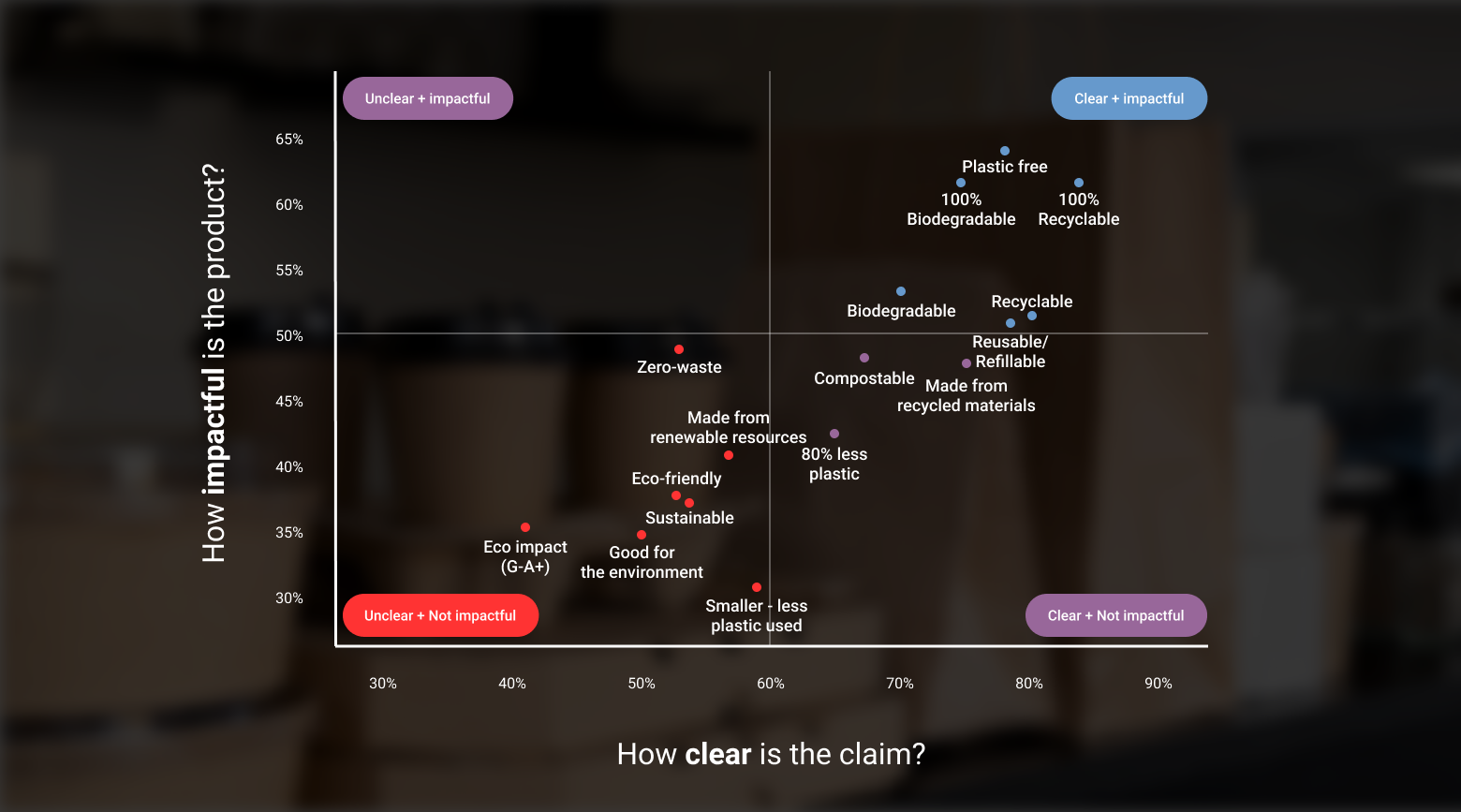

In the still novel landscape of green products, well-performing product claims are still finding their way to the consumer. In this study, the most common claims that can be found on sustainable products were evaluated using MaxDiff to understand how relevant and clear they are to the consumer – and to uncover their true potential to make a green impact. Here is how they performed on the two axes:

As seen above, one of the clear winners is ‘100% recyclable’– it is direct and clear, so it fared really well on both scales. Although a popular choice by both brands and shoppers, it can often be found in the center of the debate. A lot of product packaging that claims they are recyclable is, in fact, not when a regular consumer typically has no access to specific recycling sites or plants. An interesting note to take is that, although still a better performing claim than the rest, just ‘recyclable’ is seen as less clear and impactful than the former – suggesting that adding a number drives more impact. However, not just any number will work – as claims such as ‘80% less plastic’ is significantly lower on the clarity scale – and not only that, it was also one of that was rated as the least impactful out of the tested claims.

‘Zero waste’ is an interesting one – while it has the potential to be impactful, it ranked low on clarity. This means that although consumers know this term is a good one, they are still confused about how exactly that works, but by making it clearer as to how exactly the product is zero waste, you can boost the impact on consumer behavior. What is definite is that the worst-performing claims are the ones that are vague in how they are helping the cause – just stating Eco impact (G-A+), Sustainable or Eco-friendly is not enough to sway purchase decisions of eco-conscious shoppers.

It is important to note that none of the claims made to the top left quadrant – meaning if a claim is not clear, it will not make any impact. So when building a communication strategy for a product claim, prioritize your KPIs: make sure your claims are clear, direct, and specific in communicating how they contribute to reducing plastic pollution – but use them as a space for educating your consumers.

Driving transparency will drive awareness

Apart from being clear and relevant to eco-buyers, transparency is an area where brands can really shine through. Oftentimes, what consumers find clear on product packaging is not in fact the most sustainable option. And on top of this, and perhaps ironically, when it comes to using the phrase sustainable alone, it will not do the trick either since consumers might not understand what makes a product truly sustainable. So, by positioning your brand as a trustworthy source of information, your brand can make sure consumers are not only buying what you are selling but are being educated on how they can be responsible for a cleaner environment. As previously covered, levels of eco-awareness among shoppers differ – but through understanding their motivations behind acting green and addressing them specifically, crafting the right messaging and product claims becomes an easier task.

But some rules of thumb are: claims that are too general (e.g. ‘sustainable’) and overused (e.g., eco-friendly’) are found to be unclear and less impactful in contributing to pollution cause. If not transparent in how a product is sustainable or good for the environment – shoppers won’t buy into it. Whereas,claims that are direct clear and specific in communicating how they are reducing plastic pollution (e.g., ‘plastic-free’, ‘100% recyclable’, ‘100% biodegradable’) are the best option to place on a product package.

Sustainable doesn’t mean different

As with any new product launch, a big part of any brand’s communications strategy is ensuring that the product and the packaging claims are developed just right. Since their influence on consumer decision-making is indisputable, a well-researched and data-led selection of product claims are the ones that will end up on the pack design – so, why treat sustainable products any different? Typically, product claims should be tested with a repertoire of behavioral and traditional methods – MaxDiff followed by a questionnaire will assure that your claim resonates with the consumer, RTM shows how a claim fares on believability and likability, and lastly, eye tracking and virtual shopping measure whether the claims are even seen and the products consequently bought.

So remember, going beyond just claims – like any new product that will eventually end up on the shelf, sustainable products should meet the same thorough (behavioral) research faith.

Key takeaways:

- Product claims are the best area for describing your impact quickly

- Clarity is a must – be specific in explaining how you are contributing to solving a specific problem (e.g. ‘plastic-free’/’reusable’)

- Avoid being vague – claims such as ‘sustainable’ make it unclear to the consumer about how it is helping the plastic pollution problem

- Be brief and direct – avoid using longer copy instead of a claim (such as ‘good for the environment’) and overused phrases (‘eco-friendly’)