Many new products are introduced every year, but only 20% of cases succeed. Every brand knows that planning and successfully developing NPDs is a challenge – and experts Stijn Smet (Managing Director, AfCE), Angeliki Maragkou (Global Strategic Insights & Analytics Director, Head of CoE, Bayer), Marija Đorđević (Product Director, EyeSee), Mirna Đurić (Head of Insights, EyeSee) and Milica Kovač (Product Manager, EyeSee) deep-dived into tackling challenges, minimizing the risk on the innovation process and why is testing in pre-launch stage improve chances of success once the product hits the shelves.

Here is what experts with first-hand NPDs experiences have to say:

Bring to life the consumer needs

From the perspective of Global Strategic Insights & Analytics Director and Head of CoE at Bayer, Angeliki Maragkou, the challenge is to distill the true and unmet consumer needs. That is why she is convinced it is important to constantly thrive for cross-functional collaboration throughout the process and bring to life the unmet needs and the whole consumer’s journey – think about the experience early on in the process and understand the job that needs to be done.

At Bayer, in the late stages of innovation, combining methods with multiple approaches minimizes the risk, Angeliki added that it’s not one size fits all, and every element of the innovation should be thought out separately and all of them together. The approach of testing with a mix of combined methods enables the simulation of different scenarios to understand better the whole cycle of development, especially in the pre-launch stages.

Make it or break it innovation

Even with vast experience as an innovation consultant, Managing Director at AfCE, Stijn Smet, agrees that innovation is by default a risky business – some ideas will always end up in a dead-end street. For him, the real challenge is that many organizations either pursue ideas against all the evidence because of the lack of better alternatives, or there are too many potentially good ideas that don’t end up pursued at all.

He then focused on how successful companies do it right – they know how to experiment with innovation more than others and do so in a lean and cost-effective way. Stijn continues to explain that they need to consider how to deal with more simultaneous ideas and come up with internally scalable innovation programs that will enable intrapreneurs to de-risk their idea slightly along the journey, with some training and mentoring.

With NPD, go big or go home

When it comes to challenges in developing and testing NDPs, the Head of Insights at EyeSee, Mirna Đurić, noticed one of the biggest and most challenging things for brands is trying to make a significant impact with incremental change.

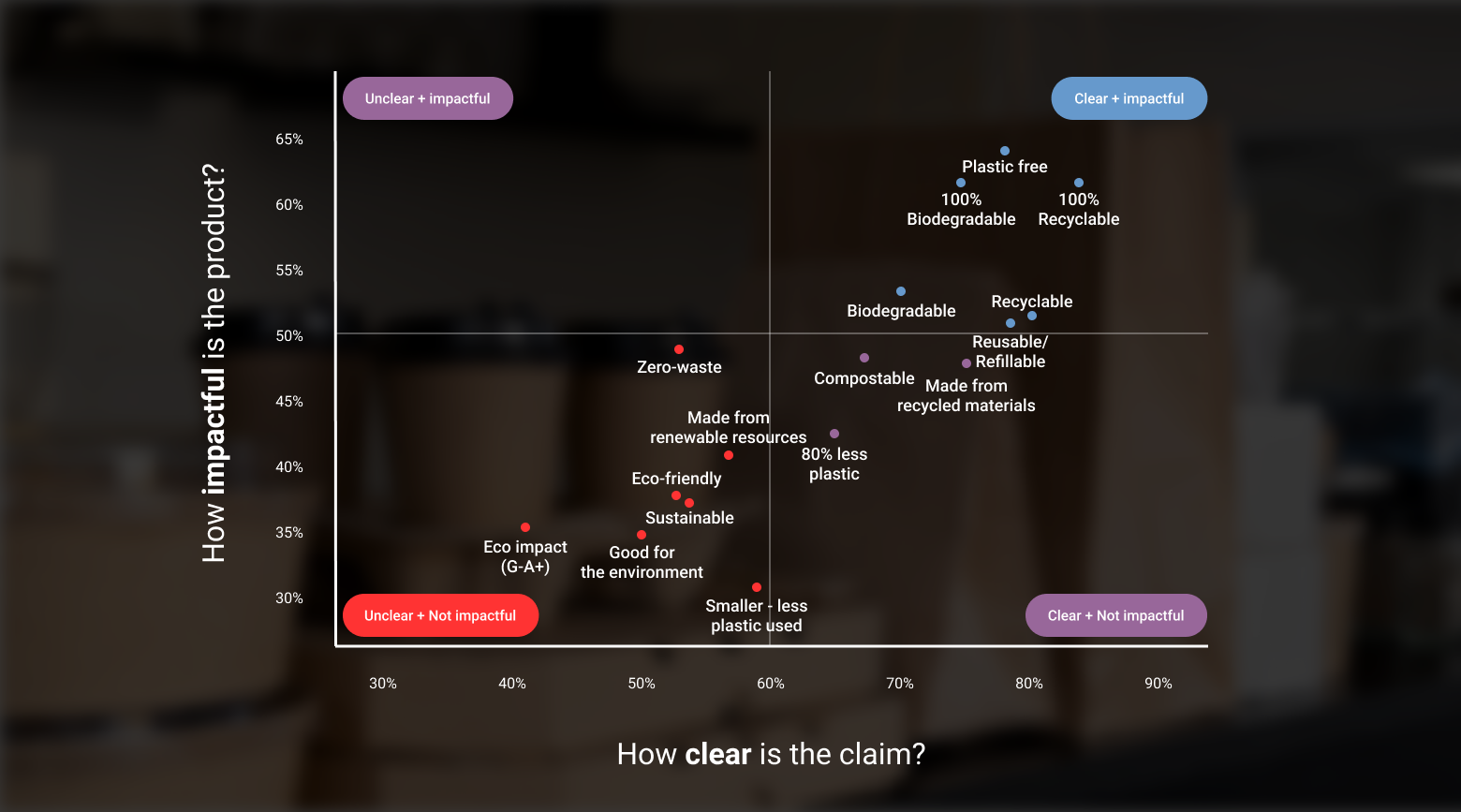

She noted that many companies want to launch the next big product without risk just by playing it safe – developing mostly new line extensions, spreading to new geographies with existing SKUs, or targeting specific SKUs from competitors with similar products. Additionally, innovations have not changed enough, especially in the domain of sustainability – whether it implies innovation in packaging, ingredients, or waste management.

Maximize the leap to minimize the risk

Drawing from years of research in NPD, Product Director at EyeSee, Marija Đorđević, reflected on how market research agencies traditionally rely on large sets of data when testing NPDs – collected from in-home usage tests combined with surveys and household panels. But, as she further explained, this model has several drawbacks – it is a very costly and lengthy process, sometimes not user-friendly for end customers.

From her perspective, there are a few steps researchers can take to effectively test NPDs – First, start the process with highly realistic online representation of brick & mortar environments through virtual shelves to provide an immersive shopping experience and yield better predictions of real-life decisions that measure behavior. Then, ensure to analyze the data with statistical rigor to understand the performance beyond SKU levels – such as category, brand portfolio, switching power, and cannibalization. She added that at EyeSee, modular standardized protocols are used to test and optimize all the different aspects of NPDs such as pricing, packs, claims, and portfolios.

It’s not the question of IF but HOW to test NPDs

With previous experience in insights, the Product Manager at EyeSee, Milica Kovač, believes that in-context testing before the launch significantly increases the chances of success. In her opinion, the logic of pre-launch testing is spreading far beyond the boundaries of FMCG – and the new normal even in IT product management is to prescreen and test before launch. She argued that the real challenge is choosing an efficient and fast methodology to get the right answer and not the wrong assessment with your research – the NPD test should be both an assessment of market potential and risk.

Milica noted that a new approach to testing in the late stages of NPD development uncovers visibility and engagement of the product on the shelf, category growth, sale increase, which elements did not reach consumers yet – and how reformulation of certain elements on the packaging can enhance NPD’s performance in the future.

Key lessons learned from innovation experts:

- Know that the NPD testing process is not linear – map out all the unmet consumer needs and revisit them frequently

- Enable your workforce to accelerate innovation development – master lean experimenting for successful NPDs

- Dare to innovate – make bigger leaps and test along the way – because that’s what opens the door to becoming a true category leader

- Have a tech-enabled approach to NPDs – use highly realistic virtual testing environments for the most predictive insights

- Make sure to wisely choose the research partner – opt for solutions that have been validated against real-life sales data

Interested in successfully launching NPDs? Reach out to us at [email protected]

![[Get recording] Win the Battle for Market Share: Launching Risk-Free NPDs](https://eyesee-research.com/wp-content/uploads/2022/02/Get-recording-Win-the-Battle-for-Market-Share-Launching-Risk-Free-NPDs.webp)