Written by Vanja Radic, Facial Coding Team Lead at EyeSee.

Many of our clients have asked what a successful social media campaign entails. In this article, we will address the most important creative aspects to have in mind when directing and optimizing social media ads. Those aspects revolve around two main pillars: attention management and emotional engagement.

TVC vs. social media

Although attention metrics can always provide additional insights, they are not essential when it comes to TVC testing; as for this advertising format, some amount of attention comes as a given – the TV is on, and we just move on to other activities until the TVC clutter dissipates. A lower level of attention is even considered a unique TVC advantage, allowing a more subliminal persuasion to take place (Heath, Robert). Countless academic discussions address the pros and cons of TVCs vs. social media advertising, however, when it comes to a younger and more specific target audience, social media marketing is without a doubt winning the game. Nevertheless, social media as an environment poses additional challenges when it comes to creating a successful video ad. Ferociously fast-moving timelines have brought on the need for marketers to become excellent managers of attention. Consequently, attention metrics come into play as the strongest indicator of success: being three times more predictive than viewability, attention metrics inform marketers about how much of the video content will actually be seen.

Let’s introduce an analogy: the difference between seeing a movie cover and seeing the whole movie or a part of it aptly illustrates the difference between viewability and attention. Unfortunately, most social media analytics limit themselves to viewability, in that way stunting the learnings from past campaigns.

Yet, it’s important to note that testing an ad only on attention metrics doesn’t give a full picture of its performance and therefore limits the feedback on where the spaces for improvement lies. Attention metrics represent only one side of the coin since they say nothing about a very important driver of attention and consumer behavior overall – emotions.

Attention vs. emotions

It’s difficult to talk about attention without appreciating emotions since they can critically modulate attentional processes and, at the same time, increase the likelihood that an emotional experience becomes part of our memory store; in turn, creating an emotional connection to the brand.

“A marketing strategy focused on appealing to consumers’ raw and most personal emotions can change a faceless, perhaps seemingly soulless, business into a brand that audiences can relate to and care about.” (Ingwer, Mark)

We are constantly bombarded by a plethora of information and experiences, only a small subset of which will be encoded into lasting memories. That small subset that is likely to be selected from the barrage of information is the emotional content. Apart from transforming experience into a memory, emotions powerfully, predictably, and pervasively influence our decision-making, which is why brands should make sure their advertising efforts elicit positive emotions.

The best way to access the emotional quality of an ad is by applying the Facial Coding method. As both appealing to emotions and managing attention are equally important, EyeSee’s methodology relies on both facial coding and attention measurement when assessing an ad’s performance on social media.

How we do it

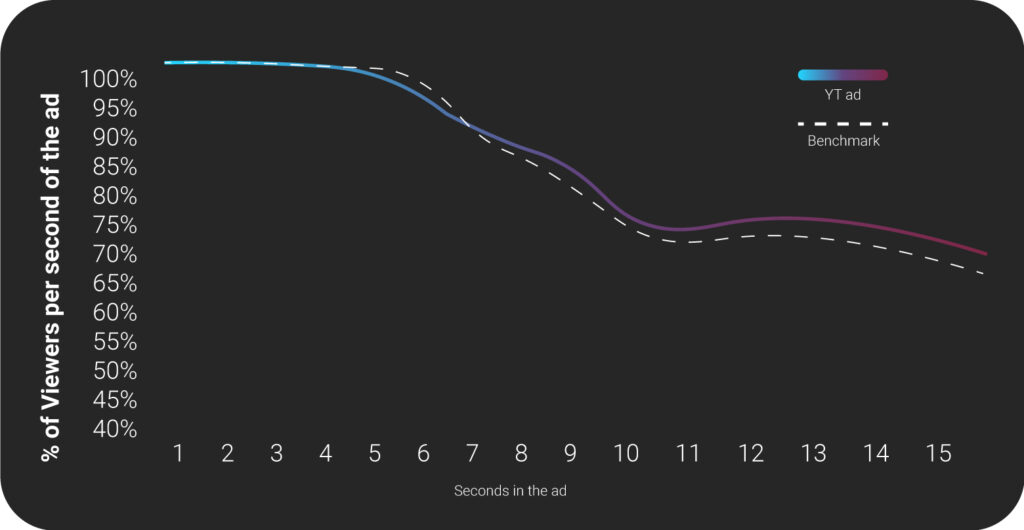

Nothing better than an example to illustrate the complementarity and uniqueness of these two methods. Here are the results from a YT ad testing study, summarized in Retention rate per second (Attention) and Emotional engagement per second (Facial Coding) graphics.

A look at attention measurements for this ad shows that the retention rate drops below the benchmark from the moment the skip button appears. This drop severely influences other attention metrics, like competition rate and overall focus, as the viewers who click the skip button are irreversibly gone (the line can only go down). Still, we can see that there is a shift in the 7th second, where the line starts to straighten, from that moment on, floating above the benchmark.

Graph 1 – Retention rate per second (Attention)

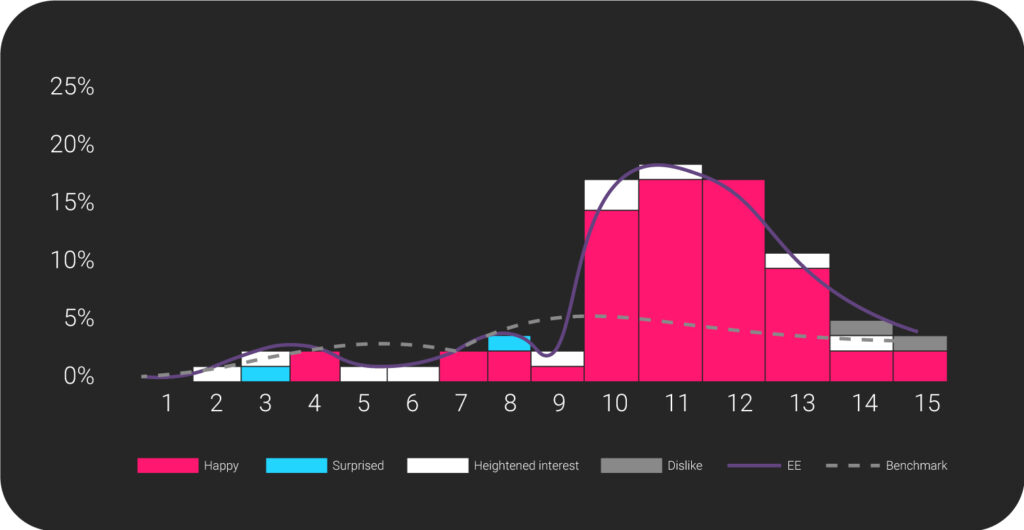

Now let’s consult the emotional metrics provided by Facial Coding:

Graph 2 – Emotional engagement per second (Facial Coding)

From the standpoint of facial coding, the ad is a high performer, reaching a 20% positive tipping point in the 11th second. Obviously, humorous scenes developing from the 7th second have done their part in positively engaging viewers’ emotions and need no further script-based modifications. If we go back to the Retention rate graphic (Graph 1), we cannot help but notice how emotions interfere with the attentional processes – i.e. attention drop-off decreases from the same moment that stimulus starts to engage the viewers. However, if we were limited to attention measurement metrics only, we might be tempted to wrongly assess this social media ad as an average-to-low performer; nevertheless, Facial Coding demonstrates its strength and potential in engaging positive emotions, hence sharpening the feedback given. Therefore, by combining both attention measurement and facial coding, we can say for certain that the biggest space for improvement lies in the first part of the stimulus; this is probably due to a lack of suspense or dynamic shift around the 5th second, that second being the stumbling stone for effective attention management in the YT environment.

Insights into social media ad performance can be even more enriched by supporting these two methods with other behavioral methods such as Eye Tracking, Virtual Shopping and Reaction Time Measurement. Given that Facial Coding yields data on how the respondents feel when exposed to an ad, Eye Tracking is utilized to pinpoint what exactly they are looking at when watching the video, uncovering the main areas of interest. And while an ad can be both entertaining and attention-grabbing for consumers, generally excelling from the creative side – the question of what it brings to the brand remains open. That is where Virtual Shopping comes into play, enabling us to measure the actual impact on sales, whereas Reaction Time Measurement ensures we understand the impact on the brand itself.

Conclusion

Relying solely on attention metrics in social media testing is not enough if we really want to learn from past experience and squeeze the most out of the input available. By applying the right combination of EyeSee’s behavioral methods, we can understand both the emotional and attention aspects of video content, which allows us to pinpoint exactly where space for improvement lies.

If understood and excavated properly, emotions can be powerful commercial tools and many brands have come to the conclusion that appealing not only to consumers’ reason and logic but also to their heartstrings can give them a competitive advantage. Besides establishing attention as an adequately managed KPI, Facial Coding method helps marketers ensure that their advertising efforts are successfully connecting with their audiences emotionally.

Heath, Robert. (2012). Seducing the subconscious: The psychology of emotional influence in advertising. Wiley-Blackwell.

Ingwer, Mark. (2012). Empathetic marketing: How to satisfy the 6 core emotional needs of your customers. Palgrave Macmillan.

Advertising Week: Attention is the New Metric

Jason Bradbury is the Senior Director of client service at EyeSee and a highly seasoned research professional of 30 years. He partnered with many Fortune 500 firms on marketing communications and shopper insights engagements.

Jason Bradbury is the Senior Director of client service at EyeSee and a highly seasoned research professional of 30 years. He partnered with many Fortune 500 firms on marketing communications and shopper insights engagements. Vinay Rao is New Business Development Director at EyeSee with a broad experience in the Market research industry across four countries in APAC and with various methodologies in shopper, innovation, and brand research.

Vinay Rao is New Business Development Director at EyeSee with a broad experience in the Market research industry across four countries in APAC and with various methodologies in shopper, innovation, and brand research.